Cheque writing

Author: g | 2025-04-25

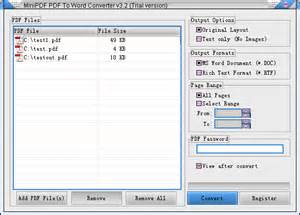

Chrysanth Cheque Writes is a professional and free cheque writing and printing software that automates the process of writing a cheque. It also converts number to words for your cheques. Chrysanth Cheque Writer Chrysanth Cheque Writes is a professional and free cheque writing and printing software that automates the process of writing a cheque. It also converts number to words for your cheques. Chrysanth Cheque Writer

Cheque Writing / Cheque Printing Software for

The cheque gets stolen.Also Read: All You Need To Know About Post-dated Cheques Add ‘only’ after you enter the amount in words Writing one word can make a huge difference when writing a cheque. You must fill in the amount in words and add ‘only’ after that. For example, if you enter the amount as Twenty thousand and forget to enter ‘only’, the chances are that the cheque can be altered to read Twenty Thousand Nine Hundred and Ninety Nine quite easily. That’s the reason why it is also imperative to add the /- sign after the figures, as 20,000 can easily be altered to 20,000,000, which is a huge sum you can become liable to pay! The right way to enter it is Twenty Thousand Only and 20,000/- respectively. Do not overwrite Be careful never to overwrite any details in your cheque. You must never scribble, cancel a word etc., on the cheque as the bank is at liberty to refuse to accept the cheque. If you make a mistake in the cheque writing format, you can always write out a new cheque. Take your time and never write cheques in a hurry. Enter the correct date Ensure you fill the date field with the right date when you do cheque writing. Not entering the date means your cheque can be drawn on any date as per the person holding the cheque wills. Your cheque can bounce, or you can face other penalties when the cheque is encashed, and

How to write a cheque

Here’s what you can do for a safe experience in writing cheques correctly: Put transparent tape over the name field and amount field before issuing the cheque so that no one can alter your cheque. Destroy cancelled cheques unless you need them for some other reason. Mention your name, account details, mobile number, and signature at the back of the cheque whenever you deposit a cheque for collection. Ensure you never issue a cheque unless it is written rightly and has the date, amount, name of the person the cheque is issued to and the account number. Ensure your account has an adequate balance before issuing a cheque. A cheque bounce is a criminal offence with severe legal consequences. Use your signature judiciously. If you doubt the signature may not be acceptable, sign again to prevent any confusion. Do not strike out the previous signature. Never staple, fold, or disfigure the cheque’s face and MICR code. Desist from issuing post-dated cheques and cheques that are dirty or defaced. Use the same pen throughout when writing a cheque. Also, never use green or red-inked pens. Make sure your handwriting is consistent and legible when writing a cheque.Also Read: Get Complete Information on Cheques in DetailConclusionThe process of how to write a cheque to someone sounds easy. However, there are various elements to a cheque. Whether it is a personal account or business account, always ensure you write your cheques correctly. Maintain all the aspects in a cheque as mentioned in thisตรวจสอบการเขียนซอฟต์แวร์สำหรับธนาคารไทย :: Cheque Writing/

Writing a cheque in French from your French bank account isn’t rocket science; however, there are a few nuances you need to understand in order to properly fill one out. Here’s what you need to know.It never fails.Whenever I’m in a rush at the grocery store, I end up behind someone slowly writing out a cheque for their groceries.Despite the popularity of debit cards, credit cards and electronic payments like PayPal, it’s still quite normal to see someone in France whip out their chequebook to pay for things like groceries, particularly in the countryside and amongst the elderly.France accounts for over half of all cheques written in the entire EU. According to the Bank of France, 7 out of every 10 cheques written in 2017 in the European Union were written in France.Even if you don’t think you’ll use cheques, there are certain situations where you may not have a choice.Here are a few situations where I personally had no choice but to write a check in France. Real estate deposit & rental depositDeposit for children’s annual sports memberships (paid to associations).Purchasing a used carAt a restaurant that doesn’t take credit cards, and when I don’t have enough cash for the bill, I just whip out my chequebook6 Steps to writing a French bank cheque1. Write the amount of the cheque in words (in French).2. Write the name of the person or business you are paying3. How to write the amount of euros in french4. Write the city location5. Write the date6. Sign the chequeSample chequeFrench Bank Cheque VocabularySharing is caring: Please consider saving this pin to Pinterest6 Steps to writing a French bank chequeI’ve got you covered.Here are the instructions on how to fill out the six areas of a French bank check.You can watch the video above.You can also study infographic below.Or you can read the instructions below the infographic. 1. Write the amount of the cheque in words (in French).Payez contre ce chèque: = Pay against this cheque.The first two lines on a French bank cheque are reserved for the cheque amount, which you must write out. Chrysanth Cheque Writes is a professional and free cheque writing and printing software that automates the process of writing a cheque. It also converts number to words for your cheques. Chrysanth Cheque WriterHow to Write a Cheque

EasyCheck: Best Cheque Printing Software in UAE, Oman, and KSA Stop Writing Cheques Print With EasyCheckSay goodbye to manual cheque writing and embrace automation with EasyCheck, the best cheque printing software trusted by leading banks and businesses. Whether you are based in the UAE, Oman, or KSA, EasyCheck is the best cheque printing software to streamline your financial operations.Revolutionize Your Financial Management with EasyCheck EasyCheck is more than just cheque printing software. It’s an essential tool for businesses looking to simplify their financial management processes. With EasyCheck, you can print cheques that are compliant with banking standards across the UAE, Qatar, KSA, and Oman. Our advanced features such as bulk cheque printing and automatic conversion of numbers to words make financial management faster and more accurate.Automated Cheque Printing for All GCC BanksWith EasyCheck, you no longer need to manually write cheques for different banks. Whether you’re dealing with Mashreq Bank, Abu Dhabi Commercial Bank (ADCB), National Bank of Oman, or Saudi National Bank, EasyCheck ensures that your cheques meet the formatting requirements of all banks in the GCC region, including UAE, Qatar, Kuwait, and Bahrain.The software supports a variety of cheque formats and ensures full compliance with local banking regulations, making it the best choice for businesses operating across multiple countries in the GCC. Why EasyCheck is the Top Choice for Businesses in UAE, Oman, KSA Key Features of EasyCheck Print Cheques for All Banks in GCCEasyCheck supports cheque printing for all major banks in the UAE, Oman, KSA, Qatar, and other GCC countries. This feature allows businesses to maintain a seamless relationship with their banking partners, no matter where they are located in the region. Automatic Post-Dated Cheque PrintingSay goodbye to manually writing post-dated cheques. With EasyCheck, you can generate post-dated cheques with pre-set dates easily without any manual calculations. This is beneficial for businesses handling large volumes of post-dated cheques. Streamlined Bulk Cheque PrintingBusinesses that issue multiple cheques daily can take advantage of EasyCheck's bulk cheque printing capabilities. You can print hundreds of cheques in one go, making it a time-saving tool for organizations that handle high transaction volumes, such as schools, retailers, and financial institutions. Unlimited Cheque TemplateWith EasyCheck, you can easily customize cheque templates according to the specific requirements of each bank. EasyCheck supports all bank templates, ensuring that all your printed cheques comply with the formatting and regulations of all banks without any hassle. Number to Words Auto-ConversionOne of the most common errors in cheque writing is the manual conversion of numbers to words. EasyCheck eliminates this risk by automatically converting cheque amounts to words, ensuring error-free transactions every time. Compatibility with All Laser PrintersNo need for special cheque printer hardware. EasyCheck is compatible withCheque Writer - Cheque Printing Writing Software

You do not have sufficient funds in the account. Also, note that the bank does not accept cheques with a future date or no date. Even entering the year or month incorrectly can cause your cheque to bounce. Don’t sign on the MICR code Your signature should be appended at the right lower corner of the cheque just above the field ‘Authorized Signatory’. Signing on the left corner defaces the cheque because the bank’s numeric identifier is mentioned in the MICR barcode. Knowing how to write in cheque is important. Or your cheque is liable to bounce when you sign over the MICR code. This is also one of the most common errors people make when writing cheques. Maintain your cheque records Maintaining a record of every cheque you write can be very helpful in the long run. It is easy to note the cheque number, amount, date and the name of the person you issue the cheque to. You can thus make sure if your cheques clear your account, keep a watch on any fraudulent or suspicious activity related to your cheques and bank account. You can also avoid any confusion in how to write a cheque due to forgetting the cheque details just in case you need to stop the cheque’s payment or issue a duplicate cheque. Safety Measures to adopt when cheque writingThe above methods are a must when you learn how to write a cheque in India. You must ensure proper safety measures in cheque writing.Cheque Writing Software to Simplify Cheque Processing

All types of laser printers, making it easy to integrate into your existing office setup. Whether you’re using HP, Canon, or Brother laser printers, you can be confident that EasyCheck will work seamlessly. Multi-User AccessNeed multiple users to handle cheque printing? EasyCheck supports multi-user access, allowing your team to collaborate on financial tasks. Administrators can also set permission levels to ensure that only authorized personnel can print cheques, enhancing security. Integration with ERP SystemsEasyCheck can integrate with your existing ERP systems, including popular platforms like SAP, Oracle, and QuickBooks. This integration streamlines the flow of financial data, reducing manual data entry and ensuring that your payment information is always up to date. Extensive Financial ReportingStay on top of your financial transactions with EasyCheck’s in-depth reporting tools. Generate reports for individual accounts, track cheque history, and get an overview of your payment processes. This feature is essential for businesses that need to ensure full compliance and auditability. Trusted by Top Banks & Companies in UAE, Oman, KSA Why EasyCheck is the Best Cheque Writing Software EasyCheck is trusted by some of the most prestigious banks and businesses across the UAE, Oman, KSA, and Qatar. Here’s why:Localized Cheque Printing Solutions: Compliant with GCC banking standards, EasyCheck supports cheque printing for businesses across the region.Automation and Accuracy: Automate key financial processes like number-to-word conversion, post-dated cheque issuance, and bulk printing, all while ensuring error-free transactions.Ease of Use: With an intuitive interface, even non-technical users can quickly master EasyCheck and streamline their cheque printing process.Top-Level Security: Only authorized personnel can print cheques, ensuring that your company’s financial data remains secure.Auto-Dated PDC Printing for Banks and Financial InstitutionsEasyCheck is revolutionizing how businesses and financial institutions manage Post-Dated Cheques (PDCs). Traditionally, managing a large volume of PDCs was a manual and error-prone process. With EasyCheck’s Auto-Dated PDC Printing, banks and companies can generate and manage PDCs with just a few clicks.This feature is particularly beneficial for sectors like real estate, automotive leasing, and financial services, where post-dated cheques are commonly used. By automating this process, EasyCheck – Best Cheque Writing Software enhances both accuracy and operational efficiency, helping businesses save time and reduce administrative burdens.Transform Your Financial Operations with EasyCheckEasyCheck empowers businesses in the UAE, Oman, KSA, and other GCC countries to transform their financial operations. From cheque printing to post-dated cheque management, EasyCheck takes the hassle out of managing cheques and ensures compliance with local regulations.With EasyCheck, you can:Save time by automating cheque printing processes.Reduce errors with automatic number-to-word conversion.Enhance security with multi-user permissions and audit trails.Improve financial transparency with detailed reporting. trusted by 1000+ businesses in the UAE, Oman, KSA Say Goodbye to Cheque Writing.Print with EasyCheck Don't let manual cheque writing slow yourCheque Printing Software, Cheque Writing Software, cheque writer, Check

One of the most common ways to pay money to someone is through cheque’s. Cheque’s give you the flexibility to make payments to someone at some later date (post dated cheque) by writing it now at this moment. Writing a cheque seems to be such a simple task, but do you know that there are many weak links in writing cheques which can create a big problem for you.If you are not careful while writing a cheque, it can be misused by someone else and potential of monitory loss to you along with unwanted headache. Today’s generation is very causal when it comes to writing the cheques. In this article, I will cover 6 must know points which you should always practice writing the cheque’s . You can see these 6 points as a step by step recipe to write cheques. Lets see them one by one1. Do not leave spaces between words or numbersIts a no-brainier. When you write numbers and words in the cheque, be it Name or amount, never leave a space or gaps between them, because that gives a chance to add some alphabet or number and change the whole cheque.Imagine you issue a cheque to “ANKIT SHARMA” , but put sufficient space between “ANKIT” and “SHARMA” and it looks like “ANKIT SHARMA” . One can add an additional “A” after “ANKIT” and the name can become “ANKITA SHARMA” . However if you just leave exact one small space between “ANKIT” and “SHARMA” , its going to be tough to add another alphabet in between.2. Make sure you cross the cheque saying “A/C Payee” If you are going to pay to some person and want to force that the payment should go to the same person bank account, in that case, you should be putting a double cross line on the left-top corner of cheque and write “A/C Payee” or “Account Payee“, which ensures that the money will get credited only to a bank account and not be handed over to someone as CASH over the counter.A lot of people forget to do this, and if. Chrysanth Cheque Writes is a professional and free cheque writing and printing software that automates the process of writing a cheque. It also converts number to words for your cheques. Chrysanth Cheque Writer Chrysanth Cheque Writes is a professional and free cheque writing and printing software that automates the process of writing a cheque. It also converts number to words for your cheques. Chrysanth Cheque Writer

Cheque Writing / Cheque Printing Software for Malaysia Banks

Option to ensure that no cash is paid against it if your cheque is stolen. Instead, it can only be debited to the receiver’s bank account. The next important field is the ‘amount’ field, where you should mention the amount you are paying in words. To avoid any alterations, draw a horizontal line across the remaining space in this field. Also, learn how to write amount in cheque and the amount in figures and make sure both the figures and amount in words are the same. Any difference in the amount can mean your cheque is returned unpaid. While entering the amount in figures, start writing as close as possible to the box edge to prevent any number inserts. Again after writing the amount, make sure you enter ‘/-’ to prevent misuse of your cheque or alterations by adding zeros. You must then sign your authorised signature in the bottom right corner of the cheque as the cheque’s drawer. The bottom left corner has a unique cheque number known as its serial number. Every cheque will have a serial number encoded from the bank’s identifying number and cheque number. It also has the drawer’s account number mentioned here. The MICR or Magnetic Link Character Recognition Code is like a barcode. It helps identify the bank uniquely along with its branch or issuing bank details and the last 2 digits forming the transaction ID.Now that we know the various fields of a cheque let us move to how to write thisCheque Writing Singapore Software - Free Download Cheque

Faster.ICICI Bank also has a small tutorial on correct way of writing cheque’s, which I have added below, just have a look at it and you should understand most of the things.Some more tips (From Readers Inputs in Comments section)Rishi Bhatia says – “Generally, while giving a cheque, i also make a point to use a cello tape on the name and amount, so that no one can change these”Jitendra says – “In the present era of mobile phones, when most of us have camera enabled cell phone, it is better idea to get a snapshot of Cheque before handing over. This way all your details will be maintained.”Use these 6 things everytime you issue a chequeNext time you write a cheque, just make sure you have done all these 6 things, and the chances of misuse of your cheque will be close to ZERO because each and every step add a security layer. Let me know if you have any tips on writing cheque in correct manner or any real life experience on this issue.. Chrysanth Cheque Writes is a professional and free cheque writing and printing software that automates the process of writing a cheque. It also converts number to words for your cheques. Chrysanth Cheque Writer Chrysanth Cheque Writes is a professional and free cheque writing and printing software that automates the process of writing a cheque. It also converts number to words for your cheques. Chrysanth Cheque WriterCheque Writing Template Software - Free Download Cheque

Cheque Writer Creation: An App for Easy Cheque WritingCheque Writer Creation is a free Android app developed by HZ Mobile App, designed to simplify the process of writing cheques. The app offers a unique feature that converts numbers into English, Malay, and Chinese languages, making it easier for users to understand and write cheques in any of these languages. Additionally, users can turn on or off the language feature according to their preferences.The app also includes a copy function that allows users to copy the text they have written and paste it into other applications. This feature saves time and effort for users who need to write multiple cheques with the same information.Overall, Cheque Writer Creation is a simple and useful app for anyone who needs to write cheques frequently. It is easy to use, and the language conversion feature makes it stand out from other cheque writing apps available in the market.Comments

The cheque gets stolen.Also Read: All You Need To Know About Post-dated Cheques Add ‘only’ after you enter the amount in words Writing one word can make a huge difference when writing a cheque. You must fill in the amount in words and add ‘only’ after that. For example, if you enter the amount as Twenty thousand and forget to enter ‘only’, the chances are that the cheque can be altered to read Twenty Thousand Nine Hundred and Ninety Nine quite easily. That’s the reason why it is also imperative to add the /- sign after the figures, as 20,000 can easily be altered to 20,000,000, which is a huge sum you can become liable to pay! The right way to enter it is Twenty Thousand Only and 20,000/- respectively. Do not overwrite Be careful never to overwrite any details in your cheque. You must never scribble, cancel a word etc., on the cheque as the bank is at liberty to refuse to accept the cheque. If you make a mistake in the cheque writing format, you can always write out a new cheque. Take your time and never write cheques in a hurry. Enter the correct date Ensure you fill the date field with the right date when you do cheque writing. Not entering the date means your cheque can be drawn on any date as per the person holding the cheque wills. Your cheque can bounce, or you can face other penalties when the cheque is encashed, and

2025-04-20Here’s what you can do for a safe experience in writing cheques correctly: Put transparent tape over the name field and amount field before issuing the cheque so that no one can alter your cheque. Destroy cancelled cheques unless you need them for some other reason. Mention your name, account details, mobile number, and signature at the back of the cheque whenever you deposit a cheque for collection. Ensure you never issue a cheque unless it is written rightly and has the date, amount, name of the person the cheque is issued to and the account number. Ensure your account has an adequate balance before issuing a cheque. A cheque bounce is a criminal offence with severe legal consequences. Use your signature judiciously. If you doubt the signature may not be acceptable, sign again to prevent any confusion. Do not strike out the previous signature. Never staple, fold, or disfigure the cheque’s face and MICR code. Desist from issuing post-dated cheques and cheques that are dirty or defaced. Use the same pen throughout when writing a cheque. Also, never use green or red-inked pens. Make sure your handwriting is consistent and legible when writing a cheque.Also Read: Get Complete Information on Cheques in DetailConclusionThe process of how to write a cheque to someone sounds easy. However, there are various elements to a cheque. Whether it is a personal account or business account, always ensure you write your cheques correctly. Maintain all the aspects in a cheque as mentioned in this

2025-04-20EasyCheck: Best Cheque Printing Software in UAE, Oman, and KSA Stop Writing Cheques Print With EasyCheckSay goodbye to manual cheque writing and embrace automation with EasyCheck, the best cheque printing software trusted by leading banks and businesses. Whether you are based in the UAE, Oman, or KSA, EasyCheck is the best cheque printing software to streamline your financial operations.Revolutionize Your Financial Management with EasyCheck EasyCheck is more than just cheque printing software. It’s an essential tool for businesses looking to simplify their financial management processes. With EasyCheck, you can print cheques that are compliant with banking standards across the UAE, Qatar, KSA, and Oman. Our advanced features such as bulk cheque printing and automatic conversion of numbers to words make financial management faster and more accurate.Automated Cheque Printing for All GCC BanksWith EasyCheck, you no longer need to manually write cheques for different banks. Whether you’re dealing with Mashreq Bank, Abu Dhabi Commercial Bank (ADCB), National Bank of Oman, or Saudi National Bank, EasyCheck ensures that your cheques meet the formatting requirements of all banks in the GCC region, including UAE, Qatar, Kuwait, and Bahrain.The software supports a variety of cheque formats and ensures full compliance with local banking regulations, making it the best choice for businesses operating across multiple countries in the GCC. Why EasyCheck is the Top Choice for Businesses in UAE, Oman, KSA Key Features of EasyCheck Print Cheques for All Banks in GCCEasyCheck supports cheque printing for all major banks in the UAE, Oman, KSA, Qatar, and other GCC countries. This feature allows businesses to maintain a seamless relationship with their banking partners, no matter where they are located in the region. Automatic Post-Dated Cheque PrintingSay goodbye to manually writing post-dated cheques. With EasyCheck, you can generate post-dated cheques with pre-set dates easily without any manual calculations. This is beneficial for businesses handling large volumes of post-dated cheques. Streamlined Bulk Cheque PrintingBusinesses that issue multiple cheques daily can take advantage of EasyCheck's bulk cheque printing capabilities. You can print hundreds of cheques in one go, making it a time-saving tool for organizations that handle high transaction volumes, such as schools, retailers, and financial institutions. Unlimited Cheque TemplateWith EasyCheck, you can easily customize cheque templates according to the specific requirements of each bank. EasyCheck supports all bank templates, ensuring that all your printed cheques comply with the formatting and regulations of all banks without any hassle. Number to Words Auto-ConversionOne of the most common errors in cheque writing is the manual conversion of numbers to words. EasyCheck eliminates this risk by automatically converting cheque amounts to words, ensuring error-free transactions every time. Compatibility with All Laser PrintersNo need for special cheque printer hardware. EasyCheck is compatible with

2025-04-17