Florida title fee calculator

Author: N | 2025-04-25

Title Transfer Fee: If you purchased a new vehicle, you may be responsible for a title transfer fee. For instance, our Florida vehicle registration fee calculator shows the state has a $75 title transfer fee. Shop around for cheap Florida auto insurance if you’re struggling with expensive registration fees.

Florida Title Insurance Fee Calculator - TitleWorks

Florida Title Insurance Rate Calculator This calculator will help estimate the cost of title insurance rate premiums based on the promulgated rates set by the Florida Department of Insurance. Florida Title Insurance Reissue Calculator This Calculator will calculate Florida Title Insurance Reissue credits based on the promulgated rates set by the Florida Department of Insurance under FAC 690-186. Florida Title Insurance Premiums as shown on Closing Disclosure The current Federal Law (effective 10/03/2015) mandates disclosing the cost of the Lender's Title Insurance independent of an Owner's Title Insurance Policy. The cost of the Owner's Title Insurance Policy is than calculated by subtracting the cost of the Lender's only policy from the combined cost of the Owner's Policy and simultaneous Lender's Policy. Therefore the resulting costs displayed on the Federal Closing Disclosure cannot be directly tied into the actual figures paid for title insurance in the State of Florida. Mortgage Payment Calculator Use this calculator to help estimate you monthly mortgage payment. Simply input the loan amount, interest rate and term. Then add insurance premium and taxes to derive a total monthly mortgage/escrow payment. Mortgage Repayment Calculator: Extra Payments.xls Mortgage Repayment Calculator: Extra Payments.xlms (enhanced with macro) Allows borrowers to specify any extra payments and see the impact on the amortization schedule, payoff date and total interest paid.

Title Insurance Title fees calculator

Purchase price Realtor commission (%) Seller pays title insurance Are you selling a single-family house? Estimated closing costs Realtor commission Title insurance Florida Documentary Stamp Tax Title and lien search fees HoA estoppel letter fees Wire transfer fees Document preparation fee Transaction fee Total % of purchase price Learn More to Save MoreWhat Are Florida Seller Closing Costs?Florida seller closing costs are lower compared to New York, and will run on average between 7% to 8% of the sale price, assuming a typical 6% Realtor commission and the seller pays for title insurance and related search fees. [...]What Are Closing Costs for a Buyer in Florida?New Yorkers buying a home in Florida will be pleasantly surprised to find that closing costs down here are substantially lower than the closing costs they're used to up north. With the exception of broker commissions, paid by the seller, [...]What Is the Seller’s Affidavit for Closing?A seller's affidavit, otherwise known as a seller's closing affidavit, is a typical document signed by the seller on closing day, along with the warranty deed, bill of sale, assignment of parking space and power of attorney, if applicable. The [...]Why do you need a Florida Bill of Sale for a home sale?A Florida Bill of Sale is one of the typical closing documents a home seller will sign in addition to the Florida Warranty Deed. A Bill of Sale is necessary because the sale of a typical home invariably will come [...]What is a Florida Warranty Deed?The Warranty Deed is used for most transactions involving an arms length buyer and seller, i.e. when the counter-parties are strangers. With a Warranty Deed, the grantor, or seller, is giving the grantee, or buyer, a guarantee of warranty that [...]What is the Seller Disclosure Form in Florida?The seller disclosure form in Florida is required by law1 to be filled out by sellers and presented to buyers after a purchase contract has been signed, and is an important part of the process of buying a condo in [...]Sample Title Commitment for a Florida Home PurchaseWe've included sample title commitment letters below for a hypothetical all cash condo purchase as well as a financed condo purchase in Miami, Florida. Notice how the title insurance commitment specifies exactly who and what is being insured, and how [...]Sample Florida ALTA 9 endorsementThe ALTA 9 endorsement is typically issued in Florida for purchases of free-standing residential houses and commercial buildings, but is not typically used for condominium buildings. It is an additional piece of insurance that protects against loss or damage resulting [...]The Complete Guide to Buying a Condo in MiamiBuying a condo in Miami is an exciting event, but it can catch many first timeTitle Fees Calculator - Madison Title

You may renew vehicle and vessel registrations up to three months in advance of the expiration date. Registrations expire at midnight on the first listed owner’s birth date, unless the owner is a business or the vehicle is a heavy truck. Trucks over 5,000 pounds expire June 30 or December 31 depending on term selected when the truck was first registered. Company owned vehicles expire on the date the vehicle was first registered.Most registrations can be renewed for a period of either one to two years. Vehicles registered to active military personnel and eligible for the discounted annual DMV fee can only be renewed for one year. To place an order to renew your registration for one or two years, click here and choose the renewal option. You may also choose to order a replacement if you already renewed but lost your plate sticker.Residents who are new to Florida must register and title their vehicle in the state of Florida within 30 days of either becoming employed, enrolling in school, or signing a lease agreement on a home. Similarly, if you purchased a vehicle you are required to complete the title transfer within 30 days of the listed sale date to avoid late penalties. To place an order to transfer a title and new registration, click here and choose the title and registration transfer option.. Title Transfer Fee: If you purchased a new vehicle, you may be responsible for a title transfer fee. For instance, our Florida vehicle registration fee calculator shows the state has a $75 title transfer fee. Shop around for cheap Florida auto insurance if you’re struggling with expensive registration fees.Title Calculator - Premier Florida Title

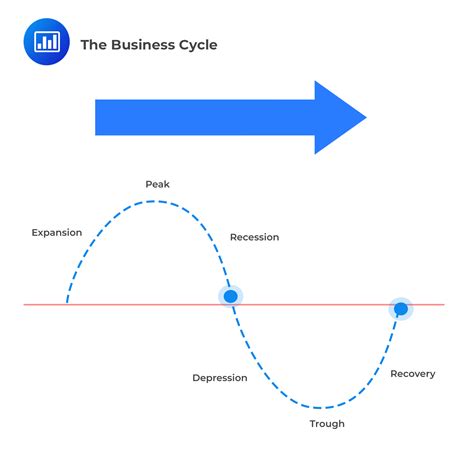

Providing a systematic way to account for the reduction in value over time. This is a common method used in accounting to allocate the cost of assets and determine their book value. All calculators 401k retirement calculator ADR calculator APY calculator Acid test ratio calculator Amortization calculator Asset finance calculator Auto loan calculator Basis point calculator Break even calculator Business loan calculator Business savings calculator Business valuation calculator California sales tax calculator Car finance calculator Car finance settlement calculator Cash flow calculator Commercial mortgage calculator Commercial real estate calculator Compound annual growth rate calculator Compound interest calculator Cost of equity calculator Currency converter Debt service coverage ratio calculator Development finance calculator Dividend calculator EBITDA calculator Employee retention credit calculator Florida sales tax calculator Franchise loan calculator Home equity line of credit payoff calculator Inflation calculator Internal rate of return calculator Invoice factoring calculator Invoice finance calculator Lease calculator Line of credit calculator Loss ratio calculator Marginal cost calculator Merchant cash advance (MCA) calculator Missouri sales tax calculator Mortgage overpayment calculator Net profit margin calculator New Jersey sales tax calculator Ohio sales tax calculator Operating margin calculator PayPal fee calculator Percentage calculator Pre money valuation calculator Price elasticity of demand calculator Price per square foot calculator Price to earnings calculator R&D tax credit calculator Rate of return calculator Receivables turnover calculator Refinance calculator Rent vs. buy calculator Return on capital employed calculator Return on investment calculator Revenue calculator SBA loan calculator Sales tax calculator Short term business loan calculator Weighted averageTitle Calculator - Florida Nation Title

To 2% of the outstanding balance.Administrative FeesReal Estate Agent Commission: You might have to pay 5% to 6% of the sale price in Realtor commissions. This includes the listing agent and the buyer’s agent fees. To cut down the commission in half consider going FSBO in Louisiana.Escrow Fee: A third party, known as an escrow, holds the property funds until the contract’s conditions are met. It typically costs around 1% to 2% of the purchase price, which is split between the buyer and the seller.Settlement Fee: The settlement fee ranges from $750 to $975. The settlement agent transfers the title from the seller to the buyer. Depending on state laws, you pay the settlement fee to the agent, title company, escrow company, or attorney.Government Fees and Real Estate TaxesProperty Tax: The tax you have to pay depends on the property value, which can be around 0.53%. The local governing body imposes this tax at closing. The prorated property tax is settled according to the purchase date.Homeowner Association (HOA) Fee: It charges monthly $100 to $500 for common area maintenance in Louisiana. If you fail to pay this fee, the HOA may foreclose on your home. HOA Estoppel Fee: The estoppel fee ranges from $100 to $500. It’s a legally binding document that outlines buyers’ post-closing financial obligations like monthly fees and outstanding dues.HOA Transfer Fee: The fee is $100 per applicant. If your house comes under HOA, then during closing, you must transfer the ownership of the home to the buyer in the HOA records.Seller Closing Costs Calculator for LouisianaUse this free seller closing cost calculator to get an estimate of how much you’ll need to pay when selling your home. Closing Cost Calculator How to Reduce Seller Closing Costs in Louisiana?These tips can help you reduce your seller closing costs:1. Opt for a Discount BrokerUnlike traditional brokers, who charge 6% of the sales price as commission, discount real estate brokers in Louisiana only charge between 0.5% and 2%. Some low-commission Realtors offer higher concessions if you let them represent you for your next real estate purchase.2. Choose “For Sale By Owner”(FSBO)Sellers can save up to 3% commission and cut several costs by opting for FSBO websites in Louisiana. Houzeo offers Flat Fee MLS packages for FSBO sellers that list properties on the MLS and make the selling process easier and pocket-friendly.3. Negotiate Better RatesNegotiation can save you thousands in seller closing costs. Instead of accepting the standard rates of attorneys, title companies, and appraisers, discuss better rates with them to reduce overall expenses.» Real Estate Attorneys in Louisiana: Find the best real estate attorneys near you.4. Negotiate With the BuyerBuyers are the ones who predominantly pay the closing costsTitle Fee Calculator – Edgewater Title Group

Buyers or out-of-towners by surprise because of how different the process is. For example, many New Yorkers used to submitting multiple, completely non-binding offers [...]Real Estate Investing in NYC vs. South FloridaI am a very small real estate investor in New York City and South Florida, and wanted to point out a few similarities and differences in being a landlord in each state. My primary residence is in New York, where [...]Why are people leaving New York in droves?Whatever your political beliefs, it's undeniable that New Yorkers are fleeing the state and NYC in particular. So why are people fleeing New York in droves? Is it because of current events like the pandemic or more endemic issues that [...]Miami Buyer Closing Cost CalculatorMiami Buyer Closing Cost Calculator Purchase price Are you financing with a mortgage? No/Yes Loan amount Are you buying a house or condo? Condo House Email Me The Results Email Me The Results Send Estimated closing costs Title insurance Settlement [...]GlossaryRealtor commission In a traditional, exclusive right to sell listing agreement, the seller agrees to pay typically 6% of the sale price in commission to the listing broker (i.e. seller’s broker) as long as a “ready, willing and able” buyer is found. This commission is often split equally in accordance with local MLS rules with the buyer’s agent, if any. Title insurance Title insurance protects the buyer of a home from defects in the title not caught by the title and municipal lien search, subject of course to certain exceptions to coverage. Title insurance is required by lenders if the buyer finances his or her home purchase. In Miami-Dade County it’s customarily for the buyer to pay for title insurance. Florida Documentary Stamp Tax Florida levies a Documentary Stamp Tax on deed transfers, also known as a transfer tax, on sellers when real property is sold. In all Florida counties except Miami-Dade, the tax rate is 0.7% of the total consideration. In Miami-Dade county, the tax rate is 0.6% on single-family home sales and 1.05% on anything else. Title and lien search fees The title search looks at the chain of title (i.e. the property’s ownership history) to see if there are any defects in the title (i.e. liens, judgments) and that the seller is the true owner of the property. A municipal lien search looks for code violations, water and sewer unpaid balances and open or expired permits. In Miami-Dade County, it’s customary for the seller to pay for the title and lien searches. HoA estoppel letter fees An estoppel letter from the HoA or condo association is a legally binding document that confirms whether the seller is up-to-date with payments, the amount of any outstanding payments,Full Service Title Escrow - Florida Title Insurance - Fees

Up to 2% of the outstanding balance.Administrative FeesReal Estate Agent Commission: You might have to pay 5% to 6% of the sale price in Realtor commissions. This includes the listing agent and the buyer’s agent fees. To cut down the commission in half consider going FSBO in Illinois.Escrow Fee: A third party, known as an escrow, holds the property funds until the contract’s conditions are met. It typically costs around 1% to 2% of the purchase price, which is split between the buyer and the seller.Settlement Fee: The settlement agent transfers the title from the seller to the buyer. Depending on state laws, you pay the settlement fee to the agent, title company, escrow company, or attorney.Government Fees and Real Estate TaxesProperty Tax: The tax you have to pay depends on the property value, which can be around 1.78%. The local governing body imposes this tax at closing. The prorated property tax is settled according to the purchase date.Documentary Stamp Tax/ Transfer Tax: It’s usually $.50 for every $1,000 of the sale price. It applies to the transfer of ownership from the seller to the buyer.Homeowner Association (HOA) Fee: It charges monthly $100 to $500 for common area maintenance in Illinois. If you fail to pay this fee, the HOA may foreclose on your home. HOA Estoppel Fee: The estoppel fee ranges from $100 to $500. It’s a legally binding document that outlines buyers’ post-closing financial obligations like monthly fees and outstanding dues.HOA Transfer Fee: If your house comes under HOA, then during closing, you must transfer the ownership of the home to the buyer in the HOA records.Seller Closing Costs Calculator for IllinoisUse this free seller closing cost calculator to get an estimate of how much you’ll need to pay when selling your home. Closing Cost Calculator How to Reduce Seller Closing Costs in Illinois?These tips can help you reduce your seller closing costs:1. Opt for a Discount BrokerUnlike traditional brokers, who charge 6% of the sales price as commission, discount real estate brokers in Illinois only charge between 0.5% and 2%. Some low-commission Realtors offer higher concessions if you let them represent you for your next real estate purchase.2. Choose “For Sale By Owner”(FSBO)Sellers can save up to 3% commission and cut several costs by opting for FSBO websites in Illinois. Houzeo offers Flat Fee MLS packages for FSBO sellers that list properties on the MLS and make the selling process easier and pocket-friendly.3. Negotiate Better RatesNegotiation can save you thousands in seller closing costs. Instead of accepting the standard rates of attorneys, title companies, and appraisers, discuss better rates with them to reduce overall expenses.» Real Estate Attorneys in Illinois: Find the best real estate attorneys near. Title Transfer Fee: If you purchased a new vehicle, you may be responsible for a title transfer fee. For instance, our Florida vehicle registration fee calculator shows the state has a $75 title transfer fee. Shop around for cheap Florida auto insurance if you’re struggling with expensive registration fees.

Calculate title insurance in florida

$7999.00 $139.00 $8000.00 + $149.00 Gate Fee (also called Load out fee). A $79.00 Gate Fee is assessed to all Copart and DRIVE Clean Title purchases. This fee covers administrative costs and the movement of the item from our storage location to the Buyer loading area. It is at the discretion of the location whether assistance is given in loading vehicles onto transport trucks. All heavy and medium duty vehicles with item numbers 801 – 900 are self-load only. Note: Other fees may apply. Please contact the Copart or DRIVE location where the vehicle is listed for more detail. A $95.00 Gate Fee is assessed to all Copart and DRIVE NON-Clean Title purchases. This fee covers administrative costs and the movement of the item from our storage location to the Buyer loading area. It is at the discretion of the location whether assistance is given in loading vehicles onto transport trucks. All heavy and medium duty vehicles with item numbers 801 – 900 are self-load only. Note: Other fees may apply. Please contact the Copart or DRIVE location where the vehicle is listed for more detail. Copart Mailing Fee. The buyer is responsible for paying the broker a $20 mailing fee that Copart charges for mailing the vehicle’s documents to the broker. Broker Mailing Fee. Non Florida resident buyers are responsible for paying the broker a $35 mailing fee ($55 for Canadian residents). The documents are sent by USPS Express Mail. If the buyer wishes to have the documents mailedTitle Fee Calculator - First American

In Massachusetts, both sellers and buyers share the closing costs, but the split isn’t equal. The closing costs in Massachusetts for sellers are 8% to 10% of the home’s sale price. Buyers shoulder a smaller portion — 2% to 5%. Sellers may pay $50,080 to $62,600 for an average $626,000 home, while buyers may spend $12,520 to $31,300. If you’re planning to buy or sell a home in the Bay State, a closing cost calculator can help you estimate your expenses. Closing Cost Calculator What Are the Sellers Closing Costs in Massachusetts?The estimated closing costs for sellers in Massachusetts can amount to 8%–10% of the home’s final sale price. However, after the NAR Settlement, sellers can avoid paying the buyer agent commissions and save up to 2.5% to 3%. Here are some of the typical closing costs for sellers:Home Inspection Fee ($325 to $425): A home inspection can help you identify potential issues before you list your home for sale.Title Search ($150 to $500): A title search verifies property ownership and identifies any liens. This ensures a smooth property transfer. Transfer Tax ($4.56 per $1,000): In Massachusetts, sellers mandatorily pay transfer tax to complete the legal transfer of the property.Real Estate Commissions (2.5% to 3%): Sellers have to pay an average commission of the home’s sale price to their listing agent.Real Estate Attorney Fees ($100 to $500): You can get assistance in drafting title deeds, short sales, and negotiations with creditors from a real estate attorney.Title-Insurance (0.5% to 1.0%): Buyers and lenders get protection against any ownership dispute with title insurance. Outstanding Mortgage Payoff: Sellers must settle the remaining mortgage amount at closing. The payoff amount can vary based on the remaining balance.» Closing Costs for Sellers: Find out what are typical closing costs for sellers in the US. What Are the Typical Closing Costs for Buyers in Massachusetts?The estimated closing costs for buyers in Massachusetts are between 2% and 5% of the home’s purchase price. Here are the typical buyers closing costs in Massachusetts:Mortgage Origination Fee (0.5%–1%): Lenders charge a mortgage origination fee for processing your loan application, underwriting, and paperwork. Appraisal Fee ($300-650): A home appraisal is necessary before you get a new mortgage or opt for a refinance. It helps you know how much loan you can get.Termite Inspection ($75-$400): A termite inspection is often needed to ensure the home is pest-free and helps you avoid future structural damage.Survey ($50-$500 Per Acre): A property survey verifies boundary lines depending on the lot size and square footage.Credit Report Fee ($10-$100): Lenders may check your credit report to access your financial history and determine the best loan terms for you. Recording Fee (Minimum $10): This is usually $10 for. Title Transfer Fee: If you purchased a new vehicle, you may be responsible for a title transfer fee. For instance, our Florida vehicle registration fee calculator shows the state has a $75 title transfer fee. Shop around for cheap Florida auto insurance if you’re struggling with expensive registration fees.CALCULATOR FOR TITLE FEES - MVD Now

Lender’s Title Insurance:Enter the Loan Amount to receive the Lender’s Insurance Amount. Lender’s Insurance is statewide regulated and is based on the Loan Amount*Endorsement not includedUp to $150,000 of liability written $4.00/MOver $150,000 and up to $250,000 add $3.25/MOver $250,000 and up to $500,000 add $2.25/M Owner’s Title Insurance:Enter the Purchase Price Amount to receive the Owner’s Insurance Amount Owner’s Insurance is statewide regulated and is based on the Purchase Price.Up to $150,000 of liability written $5.75/MOver $150,000 and up to $250,000 add $4.50/MOver $250,000 and up to $500,000 add $3.50/M **Note: The calculator will calculate insurance up to an amount of $999,999.00. Call National Title to find out the cost of owner’s title insurance above $999,000. The minimum premium amount for owner’s insurance is $175.00 for any purchase price of $30,000.00 or less.When calculating the cost of insurance, you have to round up the purchase price and/or loan amount to the nearest thousand. For example, if your purchase price is 50,001.00, you have to round up to 51,000.00 to get an accurate cost of owner’s insurance.If you have any questions, call Expert Title Escrow Agency: (937) – 291- 4201. Thank you.**Simultaneous Issue of Lender’s & Owner’s:The calculator uses the Lender Insurance Fee based on Loan Amount and subtracts it from the Owner’s Insurance amount to come up with the difference.You can also take the total amount of the Owner Insurance Amount and add $100.00 of the Lender’s Insurance to come up with a Total Amount.Comments

Florida Title Insurance Rate Calculator This calculator will help estimate the cost of title insurance rate premiums based on the promulgated rates set by the Florida Department of Insurance. Florida Title Insurance Reissue Calculator This Calculator will calculate Florida Title Insurance Reissue credits based on the promulgated rates set by the Florida Department of Insurance under FAC 690-186. Florida Title Insurance Premiums as shown on Closing Disclosure The current Federal Law (effective 10/03/2015) mandates disclosing the cost of the Lender's Title Insurance independent of an Owner's Title Insurance Policy. The cost of the Owner's Title Insurance Policy is than calculated by subtracting the cost of the Lender's only policy from the combined cost of the Owner's Policy and simultaneous Lender's Policy. Therefore the resulting costs displayed on the Federal Closing Disclosure cannot be directly tied into the actual figures paid for title insurance in the State of Florida. Mortgage Payment Calculator Use this calculator to help estimate you monthly mortgage payment. Simply input the loan amount, interest rate and term. Then add insurance premium and taxes to derive a total monthly mortgage/escrow payment. Mortgage Repayment Calculator: Extra Payments.xls Mortgage Repayment Calculator: Extra Payments.xlms (enhanced with macro) Allows borrowers to specify any extra payments and see the impact on the amortization schedule, payoff date and total interest paid.

2025-03-29Purchase price Realtor commission (%) Seller pays title insurance Are you selling a single-family house? Estimated closing costs Realtor commission Title insurance Florida Documentary Stamp Tax Title and lien search fees HoA estoppel letter fees Wire transfer fees Document preparation fee Transaction fee Total % of purchase price Learn More to Save MoreWhat Are Florida Seller Closing Costs?Florida seller closing costs are lower compared to New York, and will run on average between 7% to 8% of the sale price, assuming a typical 6% Realtor commission and the seller pays for title insurance and related search fees. [...]What Are Closing Costs for a Buyer in Florida?New Yorkers buying a home in Florida will be pleasantly surprised to find that closing costs down here are substantially lower than the closing costs they're used to up north. With the exception of broker commissions, paid by the seller, [...]What Is the Seller’s Affidavit for Closing?A seller's affidavit, otherwise known as a seller's closing affidavit, is a typical document signed by the seller on closing day, along with the warranty deed, bill of sale, assignment of parking space and power of attorney, if applicable. The [...]Why do you need a Florida Bill of Sale for a home sale?A Florida Bill of Sale is one of the typical closing documents a home seller will sign in addition to the Florida Warranty Deed. A Bill of Sale is necessary because the sale of a typical home invariably will come [...]What is a Florida Warranty Deed?The Warranty Deed is used for most transactions involving an arms length buyer and seller, i.e. when the counter-parties are strangers. With a Warranty Deed, the grantor, or seller, is giving the grantee, or buyer, a guarantee of warranty that [...]What is the Seller Disclosure Form in Florida?The seller disclosure form in Florida is required by law1 to be filled out by sellers and presented to buyers after a purchase contract has been signed, and is an important part of the process of buying a condo in [...]Sample Title Commitment for a Florida Home PurchaseWe've included sample title commitment letters below for a hypothetical all cash condo purchase as well as a financed condo purchase in Miami, Florida. Notice how the title insurance commitment specifies exactly who and what is being insured, and how [...]Sample Florida ALTA 9 endorsementThe ALTA 9 endorsement is typically issued in Florida for purchases of free-standing residential houses and commercial buildings, but is not typically used for condominium buildings. It is an additional piece of insurance that protects against loss or damage resulting [...]The Complete Guide to Buying a Condo in MiamiBuying a condo in Miami is an exciting event, but it can catch many first time

2025-04-07Providing a systematic way to account for the reduction in value over time. This is a common method used in accounting to allocate the cost of assets and determine their book value. All calculators 401k retirement calculator ADR calculator APY calculator Acid test ratio calculator Amortization calculator Asset finance calculator Auto loan calculator Basis point calculator Break even calculator Business loan calculator Business savings calculator Business valuation calculator California sales tax calculator Car finance calculator Car finance settlement calculator Cash flow calculator Commercial mortgage calculator Commercial real estate calculator Compound annual growth rate calculator Compound interest calculator Cost of equity calculator Currency converter Debt service coverage ratio calculator Development finance calculator Dividend calculator EBITDA calculator Employee retention credit calculator Florida sales tax calculator Franchise loan calculator Home equity line of credit payoff calculator Inflation calculator Internal rate of return calculator Invoice factoring calculator Invoice finance calculator Lease calculator Line of credit calculator Loss ratio calculator Marginal cost calculator Merchant cash advance (MCA) calculator Missouri sales tax calculator Mortgage overpayment calculator Net profit margin calculator New Jersey sales tax calculator Ohio sales tax calculator Operating margin calculator PayPal fee calculator Percentage calculator Pre money valuation calculator Price elasticity of demand calculator Price per square foot calculator Price to earnings calculator R&D tax credit calculator Rate of return calculator Receivables turnover calculator Refinance calculator Rent vs. buy calculator Return on capital employed calculator Return on investment calculator Revenue calculator SBA loan calculator Sales tax calculator Short term business loan calculator Weighted average

2025-04-04To 2% of the outstanding balance.Administrative FeesReal Estate Agent Commission: You might have to pay 5% to 6% of the sale price in Realtor commissions. This includes the listing agent and the buyer’s agent fees. To cut down the commission in half consider going FSBO in Louisiana.Escrow Fee: A third party, known as an escrow, holds the property funds until the contract’s conditions are met. It typically costs around 1% to 2% of the purchase price, which is split between the buyer and the seller.Settlement Fee: The settlement fee ranges from $750 to $975. The settlement agent transfers the title from the seller to the buyer. Depending on state laws, you pay the settlement fee to the agent, title company, escrow company, or attorney.Government Fees and Real Estate TaxesProperty Tax: The tax you have to pay depends on the property value, which can be around 0.53%. The local governing body imposes this tax at closing. The prorated property tax is settled according to the purchase date.Homeowner Association (HOA) Fee: It charges monthly $100 to $500 for common area maintenance in Louisiana. If you fail to pay this fee, the HOA may foreclose on your home. HOA Estoppel Fee: The estoppel fee ranges from $100 to $500. It’s a legally binding document that outlines buyers’ post-closing financial obligations like monthly fees and outstanding dues.HOA Transfer Fee: The fee is $100 per applicant. If your house comes under HOA, then during closing, you must transfer the ownership of the home to the buyer in the HOA records.Seller Closing Costs Calculator for LouisianaUse this free seller closing cost calculator to get an estimate of how much you’ll need to pay when selling your home. Closing Cost Calculator How to Reduce Seller Closing Costs in Louisiana?These tips can help you reduce your seller closing costs:1. Opt for a Discount BrokerUnlike traditional brokers, who charge 6% of the sales price as commission, discount real estate brokers in Louisiana only charge between 0.5% and 2%. Some low-commission Realtors offer higher concessions if you let them represent you for your next real estate purchase.2. Choose “For Sale By Owner”(FSBO)Sellers can save up to 3% commission and cut several costs by opting for FSBO websites in Louisiana. Houzeo offers Flat Fee MLS packages for FSBO sellers that list properties on the MLS and make the selling process easier and pocket-friendly.3. Negotiate Better RatesNegotiation can save you thousands in seller closing costs. Instead of accepting the standard rates of attorneys, title companies, and appraisers, discuss better rates with them to reduce overall expenses.» Real Estate Attorneys in Louisiana: Find the best real estate attorneys near you.4. Negotiate With the BuyerBuyers are the ones who predominantly pay the closing costs

2025-04-20Up to 2% of the outstanding balance.Administrative FeesReal Estate Agent Commission: You might have to pay 5% to 6% of the sale price in Realtor commissions. This includes the listing agent and the buyer’s agent fees. To cut down the commission in half consider going FSBO in Illinois.Escrow Fee: A third party, known as an escrow, holds the property funds until the contract’s conditions are met. It typically costs around 1% to 2% of the purchase price, which is split between the buyer and the seller.Settlement Fee: The settlement agent transfers the title from the seller to the buyer. Depending on state laws, you pay the settlement fee to the agent, title company, escrow company, or attorney.Government Fees and Real Estate TaxesProperty Tax: The tax you have to pay depends on the property value, which can be around 1.78%. The local governing body imposes this tax at closing. The prorated property tax is settled according to the purchase date.Documentary Stamp Tax/ Transfer Tax: It’s usually $.50 for every $1,000 of the sale price. It applies to the transfer of ownership from the seller to the buyer.Homeowner Association (HOA) Fee: It charges monthly $100 to $500 for common area maintenance in Illinois. If you fail to pay this fee, the HOA may foreclose on your home. HOA Estoppel Fee: The estoppel fee ranges from $100 to $500. It’s a legally binding document that outlines buyers’ post-closing financial obligations like monthly fees and outstanding dues.HOA Transfer Fee: If your house comes under HOA, then during closing, you must transfer the ownership of the home to the buyer in the HOA records.Seller Closing Costs Calculator for IllinoisUse this free seller closing cost calculator to get an estimate of how much you’ll need to pay when selling your home. Closing Cost Calculator How to Reduce Seller Closing Costs in Illinois?These tips can help you reduce your seller closing costs:1. Opt for a Discount BrokerUnlike traditional brokers, who charge 6% of the sales price as commission, discount real estate brokers in Illinois only charge between 0.5% and 2%. Some low-commission Realtors offer higher concessions if you let them represent you for your next real estate purchase.2. Choose “For Sale By Owner”(FSBO)Sellers can save up to 3% commission and cut several costs by opting for FSBO websites in Illinois. Houzeo offers Flat Fee MLS packages for FSBO sellers that list properties on the MLS and make the selling process easier and pocket-friendly.3. Negotiate Better RatesNegotiation can save you thousands in seller closing costs. Instead of accepting the standard rates of attorneys, title companies, and appraisers, discuss better rates with them to reduce overall expenses.» Real Estate Attorneys in Illinois: Find the best real estate attorneys near

2025-03-29