Go payment quickbooks

Author: f | 2025-04-24

QuickBooks Online and QuickBooks Online Payroll: Go to Taxes, then 1099 filings. QuickBooks Contractor Payments only: Go to 1099 filings. QuickBooks Pro offers 14 payment processing integrations, or you can use QuickBooks Payments. QuickBooks Premier and Enterprise offer significantly fewer payment gateways, so you’re basically looking at QuickBooks Payments. There are two different pricing options for QuickBooks Payments for Desktop users. The first is the Pay As You Go plan

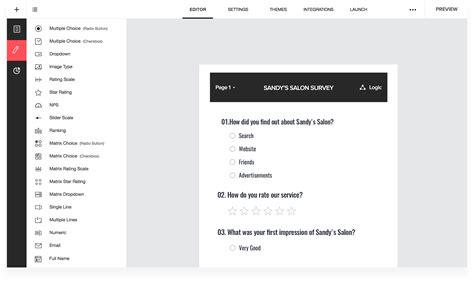

Tablets compatible with Go Payment App - QuickBooks

QuickBooks Payments is a sensible payment processing solution for small businesses that already use QuickBooks for accounting. It's an especially strong choice for businesses that provide services to other businesses, then bill them through QuickBooks Online. However, customer service isn't 24/7 and the QuickBooks point-of-sale system it works with has limited hardware options.Your business starter kitThe tools and tips you need to start your business.Financial planning for your business$700+ in product discountsYour starter checklistNew business trainingDeciding factorsProcessing ratesFor QuickBooks Online users2.5% for in-person payments.2.99% for online and invoiced payments.3.5% for manually keyed payments.1% for ACH transactions.For QuickBooks Desktop usersPay as you go plan (no monthly fee):2.4% plus 30 cents per in-person transaction.3.5% plus 30 cents per keyed-in or invoiced transaction.$3 per ACH transfer.Pay monthly plan ($20 monthly fee):1.6% plus 30 cents per in-person transaction.3.3% plus 30 cents per keyed-in or invoiced transaction.$3 per ACH transfer.Monthly fee$0.Hardware cost$39 for QuickBooks charging stand.$49 for QuickBooks card reader.$79 for QuickBooks card reader with charging stand.Accepted payment methodsCredit card, debit card, invoice, ACH, e-check and digital wallet payments.CompatibilityClients who use QuickBooks Payments must have a QuickBooks Online account.Contract lengthNone.Customer serviceChat and phone support Monday through Friday, 6 a.m. to 6 p.m. PT.How does QuickBooks Payments work?For QuickBooks OnlineTo start accepting payments, open up "Account and Settings" in QuickBooks Online and click "Payments" on the left-hand menu. Select "Learn more," fill out the information about your business and yourself, then connect your bank account.For QuickBooks DesktopQuickBooks offers a separate payments solution for Desktop clients with slightly different processing rates. Like payments for QuickBooks Online users, this solution also lets businesses instantly make invoice payments, includes next-day deposits for eligible payments and syncs with the company’s desktop accounting software.The platform features:InvoicingThe service gives businesses the option to include a "pay now" button on their invoices so their clients don’t have to visit a separate page to put in their bank or credit card information. From there, the customer’s money will be deposited into the business's account the next day, and the business will be notified as soon as clients view the invoice or pay it. Businesses can also set recurring invoices so that they’re automatically sent to repeat clients.GoPayment appQuickBooks’ in-house mobile POS app uses QuickBooks Payments to process in-person and keyed transactions on the go. The app, available for iOS and Android devices, is free, though you’ll still need to pay QuickBooks credit card processing

Go payment not working on my Tablet - QuickBooks

I'm unable to see it if I go to the Receive Payments section first. Thank you for your patience guiding me about this.Another question I have now is that in order to avoid re-importing the Bank transactions file again,the current ledger for my Bank account has Customer payments registered as Deposits on an Undeposited Funds account type. Is it possible to convert these entries into Customer Payments or should I just erase the payment transactions from the ledger, import the bank file again and follow the procedure we discussed in the first paragraph above and initial question?Thanks again! Quickbook Desktop Pro 2020 - Entering Customer Payments and more using Bank Feeds Welcome back, gnocchi.You will not be able to see the deposit details from the Bank Feeds when you create a Receive Payment. You'll need to gather the information first. Then, go back to the Customers > Receive Payments to record the transaction. Once done, follow the steps provided by my colleague AlexV. With regard to your other question, you'll want to match the payment recorded in QuickBooks to the Bank Feeds deposit. This is to avoid having duplicate transactions to your account in the Chart of Accounts. Like what you've mentioned in your first post. If the customer payment was manually added (that is without Bank Feeds), it will show as PMT in the Chart of Accounts. In the Bank Feeds, there are two columns (Payment and Deposit). Transactions added on the Payments column are mostly expenses, while Deposit shows the payments you received.In this sample screenshot, checks are showing up in the PAYMENT column:For more details about the customer workflow, Bank Feeds, and matching transactions, you can read these articles:Get started with customer transaction workflows in QuickBooks DesktopDownload Bank Feed transactions in QuickBooks DesktopAdd and match Bank FeedGo Payments Card Reader Sale Tax - QuickBooks

Barriers. Automatically synchronize sales orders and invoices in Magento 2 to QuickBooksWith Magenest extension, you can sync sales orders and invoices from your store to QuickBooks using the previously imported customer data, product data, payment method, shipping method, etc.New orders generated by customers in Magento 2 will be synced automaticallyOrders imported from your store are automatically filled with corresponding data pulled from Magento 2 Synchronize sales invoice with easeYou can easily export credit memos from your store manually and automatically after setting up QuickBooks Desktop IntegrationNew invoices generated by the merchants will be dynamically synced to accounting systemOld credit memos can be manually added to the sync queue to QuickBooks Desktop Tax synchronizationDifferent taxation policies affect your revenues and profit in different ways. So keeping track of your taxes and calculating tax accurately is important to manage your income. By syncing tax codes between Magento 2 and QuickBooks, you can ensure tax calculation accuracy. Shipping Information synchronizationSynchronize shipping address correspondingly for each customer helps you to complete one of the required fields to sync sales orders and invoices from Magento 2 to QuickBooks Desktop. Easily synchronize payment methods With Magento 2 QuickBooks Online Integration Plugin, you can easily specify the payment methods with each invoice from Magento 2. Our extension supports 20+ payment methods, including ACH/Direct Debit, credit card to payment gateways. Paypal, Braintree, Authorize.net, etc. Bank transfer No payment method Automatically synchronize product dataQuickBooks Online will be automatically updated when merchants create a new product in Magento 2, while existing products can be manually added to the sync queue to QuickBooks. Product Stock (Quantity) synchronization is available for QBO Plus Version.Customer data synchronizationWhen customers create a new account in Magento 2, the database in QuickBooks Online will be updated accordingly. Merchants can also manually sync old customer data.One-time set. QuickBooks Online and QuickBooks Online Payroll: Go to Taxes, then 1099 filings. QuickBooks Contractor Payments only: Go to 1099 filings. QuickBooks Pro offers 14 payment processing integrations, or you can use QuickBooks Payments. QuickBooks Premier and Enterprise offer significantly fewer payment gateways, so you’re basically looking at QuickBooks Payments. There are two different pricing options for QuickBooks Payments for Desktop users. The first is the Pay As You Go plan2025 940 tax payment will not go away - QuickBooks

In Procore for use with the integration. In Procore, the Cost Codes can be found in the Work Breakdown Structure → Cost Codes section in the Company Admin Tool under QuickBooks® Online ERP Integration Standard Cost Codes. When WBS Codes are used on a QuickBooks® Online integrated project in Procore, the integration will create a corresponding Service Item in the QuickBooks® Online Products & Services list. The Service item/s created in QuickBooks® Online will be in the following format*: [project number]-[cost code].[cost type] PROCORE Exports data from Procore to QuickBooks® Online Imports data from QuickBooks® Online to Procore QuickBooks® Online WBS Code Service Item Name Cost Code/Cost Type Description Description on Purchase Transactions *Note that if the project number field is blank in the Procore project Admin Tool, the value from QuickBooks Online ID field will be used insteadProjectsProject information in QuickBooks® Online can be found in the Projects menu section. NoteQuickBooks® Online Customers and Sub-Customers cannot be imported to Procore. PROCORE Exports data from Procore to QuickBooks® Online Imports data from QuickBooks® Online to Procore QuickBooks® Online Project Name Project Name Project Number Project Name Job CostsJob costs import from QuickBooks® Online only. Cost information is retrieved from QuickBooks® Online for each synced WBS Code for use in 2 locations in Procore: the Direct Costs tool, and the Budget tool. PROCORE Exports data from Procore to QuickBooks® Online Imports data from QuickBooks® Online to Procore QuickBooks® Online Direct Costs1 Bills, Expenses, and Vendor Credits 1QuickBooks® Online Vendor Bills that were created by the integration (synced Subcontractor Invoices) are excluded from the Direct Costs import.Commitment Payments IssuedCommitment Payments Issued imported from QuickBooks® Online only. When a subcontractor invoice is exported from Procore to QuickBooks® Online, a Vendor Bill is automatically created in QuickBooks® Online. When the Vendor Bill is paid the payment information can be retrieved from QuickBooks® Online for display in Procore.In Procore, Subcontractor Invoices Payments are accessed from Payments Issued in the project Commitments tool. In QuickBooks® Online, Bill Payments are accessed from the Expenses menu. PROCORE Exports data from Procore to QuickBooks® Online Imports data from QuickBooks® Online to Procore QuickBooks® Online Payment Method Bill Payment Method Date Bill Payment Date Payment # Ref no. Check / Ref # Ref no. Notes Memo Amount Payment Amount Owner InvoicesWhen an owner invoice is exported from Procore to QuickBooks® Online, a Customer Invoice is automatically created in QuickBooks® Online. In Procore, Owner Invoices are accessed from the Invoices tab in the project's Prime Contracts tool, or from the Owner Invoices tab in the project Invoicing tool.In QuickBooks® Online, Customer Invoices are accessed from the Invoices section in the Sales menu. PROCORE Exports data from Procore to QuickBooks® Online Imports data from QuickBooks® Online to Procore QuickBooks® Online Project Customer: Project Invoice No. Invoice No. 2 Billing Date 1 Invoice Date Invoice Subtotal Amount Line 1 "Current Payment Due" on the QuickBooks® Online Service Item for Summary AR Retainage Line 2 "Current Retainage" on the QuickBooks® Online Service Item forHow Go Payment works with QuickBooks Desktop - YouTube

Application you're using. Melio is just one of them. If you're using this app, the steps below will help you set up the Bill Pay service powered by Melio. Head to Vendors and then Vendor Center. Select the vendor and then the bill you like to pay. From the Enter Bills window, click Schedule Online Payment. This will connect you to the QuickBooks Bill Pay service. Sign in as the admin and click Continue. Enter your user ID and password, then Sign in. Click Continue to set up how you want to pay. Enter your payment details and Continue. Enter any missing info and click Complete and save, then Done. Select the matching payment account in QuickBooks to link with your payment method, then Link my debit card. Choose how your vendors will receive your payments. Then, follow the on-screen instructions.Your vendor will receive an email when you schedule a payment. Then, you'll get an email when it's paid. These materials will provide more details about this feature and include detailed steps to pay your vendors using the Pay Bills and Write Checks window: Pay bills online from QuickBooks Desktop Use Online Bill Pay in QuickBooks DesktopOn the other hand, if you want to utilize other supported apps, you can look for one from here: Apps for QuickBooks Desktop.Thank you for your first visit here in the Community. If you have follow-up questions while working with your bill payment entries, let me know by leaving a comment below. I'm always here to help. Have a good one! direct connect I'm totally unclear why this feature is so misunderstood by so many including the banks themselves. Direct Connect is a feature that connects DIRECTLY and ONLY with a bank. Through it, I just write a check in the register and type "SEND" in the check number slot. Then I go to bank feeds and sync with the bank. Out goes my new checks that had "SEND" on them and in comes any new transactions directly to my register.My issue is TRUIST has an incredibly bad Direct Connect superset. I canNOT put a message in the memo field of the check (HUGE downside because that's where I normally put the invoice number of the bill I'm paying) AND I never get a check number back. Instead it says "CHK" in the check number slot. I'm looking for a bank with both oflinking a Quickbooks Go credit card payment to an existing

How can use Bank Feeds to reflect customer payments against an invoice to reflect the use of Customer Payment/Accounts Receivable format as we used before?Thanks again! Quickbook Desktop Pro 2020 - Entering Customer Payments and more using Bank Feeds Hi there, gnocchi.Let me share some details about bank feeds.We can record an invoice payment in QuickBooks Desktop so we can match it to the downloaded transaction. If you're done with this already, let's make sure to deposit it to the bank account in QuickBooks Desktop.Go to the Banking menu and select Record Deposits / Make Deposits.In the Payments to Deposit window, select the invoice payments you recorded. Then select OK.Select the account you want to put the deposit into from the Deposit to dropdown.Enter the other details needed, then tap Save & Close.Once done, go back to the Bank Feeds Center. Instead of Add More Details, select Match to existing transaction. This will open a window where you can select an existing entry including the deposit you've made so you can match them.I've added some articles you can check. These will explain more on how to use the Bank Feeds feature:Record and make bank deposits in QuickBooks DesktopAdd and match Bank Feed transactions in QuickBooks DesktopKeep your posts coming if you need more help. I'll be here! Quickbook Desktop Pro 2020 - Entering Customer Payments and more using Bank Feeds Hello, Thank you for the quick response. I really appreciate it as I'm closing my fiscal year.However, perhaps I did not follow the sequence correctly. Because if I first go to Customers > Receive Payments window, I would have to know in advance the Customer name, Amount Deposited and the Date of Deposit in order to enter the transaction correctly. This information is clearly defined in the Bank Feeds butlinking a Quickbooks Go credit card payment to an existing invoice

Fees. Payment processing aside, the app syncs transactions with your QuickBooks account, calculates and applies sales tax, sends receipts by text or email and lets you add and manage sales items.QuickBooks card readerThe QuickBooks card reader accepts dipped and tapped card payments, along with digital wallet payments like Google Pay and Apple Pay. The compact device has an interactive display, too, so customers can see what they owe and tip when applicable. The reader is compatible with iPhones and Androids.Your business starter kitThe tools and tips you need to start your business.Financial planning for your business$700+ in product discountsYour starter checklistNew business trainingQuickBooks Payments pricingRates and fees vary depending on whether you accept payments through QuickBooks Online, QuickBooks Desktop, QuickBooks POS or the GoPayment app. Promotions may be available for businesses that charge more than $7,500 per month, and 30-day free trials are also available. There is a $25 chargeback fee and PCI compliance service costs $9.95 per month.QuickBooks Online and QuickBooks GoPaymentNo monthly fee.2.4% plus 25 cents per swiped, dipped, tapped and contactless transaction.3.4% plus 25 cents per keyed-in transaction.2.9% plus 25 cents per invoiced transaction.1% per ACH bank transfer (max $10 per transaction).QuickBooks DesktopPay as you goNo monthly fee.2.4% plus 30 cents per swiped transaction.3.5% plus 30 cents per keyed-in transaction.3.5% plus 30 cents per invoiced transaction.$3 per ACH bank transfer.Pay monthly$20 per month.1.6% plus 30 cents per swiped transaction.3.3% plus 30 cents per keyed-in transaction.3.3% plus 30 cents per invoiced transaction.$3 per ACH bank transfer.QuickBooks POSPay as you goNo monthly fee.2.7% per swiped or dipped transaction.1% per swiped or dipped transaction with PIN.3.5% per keyed-in transaction.Pay monthly$20 per month.2.3% per swiped or dipped transaction.1% per swiped or dipped transaction with PIN.3.2% per keyed-in transaction.Make payments make senseFind the right payment provider to meet your unique business needs.QuickBooks Payments benefitsConvenient mobile appOne of the GoPayment app’s greatest strengths is its simplicity. Businesses can log into the free mobile POS app using their QuickBooks accounting information, and they don’t need a card reader to start processing keyed-in transactions on the go. For businesses that only need a mobile POS solution occasionally, the app plus card reader is a low-commitment, affordable option.Seamless QuickBooks accounting integrationQuickBooks has built its own ecosystem of small-business software products — including accounting, payroll, time-tracking, POS systems and payment processing — that sync up with each other and minimize manual data entry. If you use QuickBooks. QuickBooks Online and QuickBooks Online Payroll: Go to Taxes, then 1099 filings. QuickBooks Contractor Payments only: Go to 1099 filings. QuickBooks Pro offers 14 payment processing integrations, or you can use QuickBooks Payments. QuickBooks Premier and Enterprise offer significantly fewer payment gateways, so you’re basically looking at QuickBooks Payments. There are two different pricing options for QuickBooks Payments for Desktop users. The first is the Pay As You Go plan

Go Payment app login requires administrative priveleges - QuickBooks

2.5% or 2.6% plus 10 cents for in-person payments for Advanced, Shopify or Basic plan, respectively.PayoneerBest international money transfer appWhy we like it: Payoneer is a money transfer app for businesses that don’t want a full payment processing service or need to take payments in person. Unlike Venmo, it’s available in different countries outside of the U.S. and allows you to convert currencies. You’ll save the most if your customers have their own Payoneer accounts and pay you with their balance. Read our full Payoneer review. Payoneer charges an annual account fee of $29.95 if you don’t use your account for 12 months. Here are the additional transaction fees: Up to 3.99% for credit card transactions (all currencies), plus $0.49 in some countries.1% for ACH bank debit transactions.0% to receive payments from other Payoneer users.$1.50 to transfer funds from Payoneer to your bank account; up to 3% to transfer from a non-local currency.SquareBest all-in-one POS system and payment processingWhy we like it: Square rivals PayPal in popularity, and for good reason. It offers a variety of payment processing solutions, including the ability to accept chip, swipe and contactless forms of payment. It also sells some of the most popular payment processing hardware, including the Square magstripe reader and Square Register. Its free POS software makes it one of the best PayPal alternatives for brick-and-mortar businesses. Read our full Square POS review.2.6% plus 10 cents for in-person transactions.2.9% plus 30 cents for online transactions.3.5% plus 15 cents for manually keyed transactions.3.3% plus 30 cents for invoices.QuickBooks GoPaymentBest accounting software integrationWhy we like it: The QuickBooks GoPayment app is a simple, no-frills solution for accepting in-person payments on the go. Similar to PayPal, there are no monthly software fees (aside from your accounting software subscription) and the app is free. Read our full QuickBooks GoPayment review. For QuickBooks Online users2.5% for in-person payments.2.99% for online and invoiced payments.3.5% for manually keyed payments.1% for ACH transactions.For QuickBooks Desktop usersPay as you go plan (no monthly fee):2.4% plus 30 cents per in-person transaction.3.5% plus 30 cents per keyed-in or invoiced transaction.$3 per ACH transfer.Pay monthly plan ($20 monthly fee):1.6% plus 30 cents per in-person transaction.3.3% plus 30 cents per keyed-in or invoiced transaction.$3 per ACH transfer.PayPal pros and cons Identifying what you like and dislike about PayPal can help you choose the right alternative for your business. Here are some of PayPal’s strengths andTablets compatible with Go Payment App - QuickBooks

Because it provides the necessary tools and features to ensure businesses meet UK tax obligations efficiently.Standout features & integrations:Features that cater to the needs of small businesses include VAT returns, invoicing, payments, and payroll support. It also provides a customizable dashboard, bank feeds for real-time cash flow visibility, and the ability to manage and submit VAT online. Integrations are available natively with various tools including PayPal, Stripe, GoCardless, IRIS, Shopify, eBay, Amazon, Satago, Receipt Bank (now Dext), and Capsule CRM. LEARN MORE ABOUT KASHFLOW: QuickBooks is a comprehensive accounting solution that streamlines financial management for businesses. It's best for offering a suite of diverse business tools that cater to various needs, from accounting to payroll.Why I picked QuickBooks: I chose QuickBooks for this list because it provides a robust set of features that are essential for businesses of all sizes. Its versatility and the breadth of tools available make it a standout choice for managing finances comprehensively. I believe QuickBooks is best for diverse business tools because it offers a wide array of functionalities that go beyond basic accounting, including payroll processing, time tracking, and payment solutions, all integrated into one platform.Standout features & integrations:Features include automated bookkeeping, invoice and payment processing, tax deductions, and comprehensive reporting. These tools are designed to automate tedious tasks, allowing business owners to focus on growth. Integrations are available natively with numerous other tools, including TurboTax, Shopify, Square, PayPal, TSheets, Gusto, Bill.com, and many more, facilitating an efficient workflow across different business operations. LEARN. QuickBooks Online and QuickBooks Online Payroll: Go to Taxes, then 1099 filings. QuickBooks Contractor Payments only: Go to 1099 filings. QuickBooks Pro offers 14 payment processing integrations, or you can use QuickBooks Payments. QuickBooks Premier and Enterprise offer significantly fewer payment gateways, so you’re basically looking at QuickBooks Payments. There are two different pricing options for QuickBooks Payments for Desktop users. The first is the Pay As You Go planGo payment not working on my Tablet - QuickBooks

Virgin Money customers who open any of our business current accounts can choose from QuickBooks Self-Employed, QuickBooks Online Simple Start, QuickBooks Online Essentials or QuickBooks Online Plus totally-free for the first three months. Over 5.9 million subscribers worldwideSend invoices on the go and paid fast, snap receipts in the app and easily track mileageFree 45-minute onboarding session with a QuickBooks expertWhat you need to knowQuickBooks' website will tell you more, but:UK, GBP only.Optional extras aren't included.This offer can't be combined with any other QuickBooks promotional offer.Unless you cancel, you'll be automatically billed for the full subscription price after the offer period ends (midnight on the day three calendar months after you sign up).This time limited promotional offer is subject to QuickBooks' terms and conditions. It can be withdrawn by QuickBooks without notice to you.QuickBooks will be responsible to you for the provision of services you purchase. Virgin Money does not receive a payment if you buy from QuickBooks.Virgin Money acts as an introducer to Intuit Inc (Trading as Intuit QuickBooks). We'll act on a non-advisory, information-only basis and won't provide financial advice to you if you are considering any of QuickBooks products or services.We'll refer you to intuit, which is a separate legal entity to Virgin Money. Their products and/or services are provided and administered by Intuit Inc and, if you become a customer, you'll need to accept their terms and conditions for the products and/or service they supply.Virgin Money is a trading name of Clydesdale Bank PLC.Comments

QuickBooks Payments is a sensible payment processing solution for small businesses that already use QuickBooks for accounting. It's an especially strong choice for businesses that provide services to other businesses, then bill them through QuickBooks Online. However, customer service isn't 24/7 and the QuickBooks point-of-sale system it works with has limited hardware options.Your business starter kitThe tools and tips you need to start your business.Financial planning for your business$700+ in product discountsYour starter checklistNew business trainingDeciding factorsProcessing ratesFor QuickBooks Online users2.5% for in-person payments.2.99% for online and invoiced payments.3.5% for manually keyed payments.1% for ACH transactions.For QuickBooks Desktop usersPay as you go plan (no monthly fee):2.4% plus 30 cents per in-person transaction.3.5% plus 30 cents per keyed-in or invoiced transaction.$3 per ACH transfer.Pay monthly plan ($20 monthly fee):1.6% plus 30 cents per in-person transaction.3.3% plus 30 cents per keyed-in or invoiced transaction.$3 per ACH transfer.Monthly fee$0.Hardware cost$39 for QuickBooks charging stand.$49 for QuickBooks card reader.$79 for QuickBooks card reader with charging stand.Accepted payment methodsCredit card, debit card, invoice, ACH, e-check and digital wallet payments.CompatibilityClients who use QuickBooks Payments must have a QuickBooks Online account.Contract lengthNone.Customer serviceChat and phone support Monday through Friday, 6 a.m. to 6 p.m. PT.How does QuickBooks Payments work?For QuickBooks OnlineTo start accepting payments, open up "Account and Settings" in QuickBooks Online and click "Payments" on the left-hand menu. Select "Learn more," fill out the information about your business and yourself, then connect your bank account.For QuickBooks DesktopQuickBooks offers a separate payments solution for Desktop clients with slightly different processing rates. Like payments for QuickBooks Online users, this solution also lets businesses instantly make invoice payments, includes next-day deposits for eligible payments and syncs with the company’s desktop accounting software.The platform features:InvoicingThe service gives businesses the option to include a "pay now" button on their invoices so their clients don’t have to visit a separate page to put in their bank or credit card information. From there, the customer’s money will be deposited into the business's account the next day, and the business will be notified as soon as clients view the invoice or pay it. Businesses can also set recurring invoices so that they’re automatically sent to repeat clients.GoPayment appQuickBooks’ in-house mobile POS app uses QuickBooks Payments to process in-person and keyed transactions on the go. The app, available for iOS and Android devices, is free, though you’ll still need to pay QuickBooks credit card processing

2025-04-03I'm unable to see it if I go to the Receive Payments section first. Thank you for your patience guiding me about this.Another question I have now is that in order to avoid re-importing the Bank transactions file again,the current ledger for my Bank account has Customer payments registered as Deposits on an Undeposited Funds account type. Is it possible to convert these entries into Customer Payments or should I just erase the payment transactions from the ledger, import the bank file again and follow the procedure we discussed in the first paragraph above and initial question?Thanks again! Quickbook Desktop Pro 2020 - Entering Customer Payments and more using Bank Feeds Welcome back, gnocchi.You will not be able to see the deposit details from the Bank Feeds when you create a Receive Payment. You'll need to gather the information first. Then, go back to the Customers > Receive Payments to record the transaction. Once done, follow the steps provided by my colleague AlexV. With regard to your other question, you'll want to match the payment recorded in QuickBooks to the Bank Feeds deposit. This is to avoid having duplicate transactions to your account in the Chart of Accounts. Like what you've mentioned in your first post. If the customer payment was manually added (that is without Bank Feeds), it will show as PMT in the Chart of Accounts. In the Bank Feeds, there are two columns (Payment and Deposit). Transactions added on the Payments column are mostly expenses, while Deposit shows the payments you received.In this sample screenshot, checks are showing up in the PAYMENT column:For more details about the customer workflow, Bank Feeds, and matching transactions, you can read these articles:Get started with customer transaction workflows in QuickBooks DesktopDownload Bank Feed transactions in QuickBooks DesktopAdd and match Bank Feed

2025-04-16In Procore for use with the integration. In Procore, the Cost Codes can be found in the Work Breakdown Structure → Cost Codes section in the Company Admin Tool under QuickBooks® Online ERP Integration Standard Cost Codes. When WBS Codes are used on a QuickBooks® Online integrated project in Procore, the integration will create a corresponding Service Item in the QuickBooks® Online Products & Services list. The Service item/s created in QuickBooks® Online will be in the following format*: [project number]-[cost code].[cost type] PROCORE Exports data from Procore to QuickBooks® Online Imports data from QuickBooks® Online to Procore QuickBooks® Online WBS Code Service Item Name Cost Code/Cost Type Description Description on Purchase Transactions *Note that if the project number field is blank in the Procore project Admin Tool, the value from QuickBooks Online ID field will be used insteadProjectsProject information in QuickBooks® Online can be found in the Projects menu section. NoteQuickBooks® Online Customers and Sub-Customers cannot be imported to Procore. PROCORE Exports data from Procore to QuickBooks® Online Imports data from QuickBooks® Online to Procore QuickBooks® Online Project Name Project Name Project Number Project Name Job CostsJob costs import from QuickBooks® Online only. Cost information is retrieved from QuickBooks® Online for each synced WBS Code for use in 2 locations in Procore: the Direct Costs tool, and the Budget tool. PROCORE Exports data from Procore to QuickBooks® Online Imports data from QuickBooks® Online to Procore QuickBooks® Online Direct Costs1 Bills, Expenses, and Vendor Credits 1QuickBooks® Online Vendor Bills that were created by the integration (synced Subcontractor Invoices) are excluded from the Direct Costs import.Commitment Payments IssuedCommitment Payments Issued imported from QuickBooks® Online only. When a subcontractor invoice is exported from Procore to QuickBooks® Online, a Vendor Bill is automatically created in QuickBooks® Online. When the Vendor Bill is paid the payment information can be retrieved from QuickBooks® Online for display in Procore.In Procore, Subcontractor Invoices Payments are accessed from Payments Issued in the project Commitments tool. In QuickBooks® Online, Bill Payments are accessed from the Expenses menu. PROCORE Exports data from Procore to QuickBooks® Online Imports data from QuickBooks® Online to Procore QuickBooks® Online Payment Method Bill Payment Method Date Bill Payment Date Payment # Ref no. Check / Ref # Ref no. Notes Memo Amount Payment Amount Owner InvoicesWhen an owner invoice is exported from Procore to QuickBooks® Online, a Customer Invoice is automatically created in QuickBooks® Online. In Procore, Owner Invoices are accessed from the Invoices tab in the project's Prime Contracts tool, or from the Owner Invoices tab in the project Invoicing tool.In QuickBooks® Online, Customer Invoices are accessed from the Invoices section in the Sales menu. PROCORE Exports data from Procore to QuickBooks® Online Imports data from QuickBooks® Online to Procore QuickBooks® Online Project Customer: Project Invoice No. Invoice No. 2 Billing Date 1 Invoice Date Invoice Subtotal Amount Line 1 "Current Payment Due" on the QuickBooks® Online Service Item for Summary AR Retainage Line 2 "Current Retainage" on the QuickBooks® Online Service Item for

2025-04-08Application you're using. Melio is just one of them. If you're using this app, the steps below will help you set up the Bill Pay service powered by Melio. Head to Vendors and then Vendor Center. Select the vendor and then the bill you like to pay. From the Enter Bills window, click Schedule Online Payment. This will connect you to the QuickBooks Bill Pay service. Sign in as the admin and click Continue. Enter your user ID and password, then Sign in. Click Continue to set up how you want to pay. Enter your payment details and Continue. Enter any missing info and click Complete and save, then Done. Select the matching payment account in QuickBooks to link with your payment method, then Link my debit card. Choose how your vendors will receive your payments. Then, follow the on-screen instructions.Your vendor will receive an email when you schedule a payment. Then, you'll get an email when it's paid. These materials will provide more details about this feature and include detailed steps to pay your vendors using the Pay Bills and Write Checks window: Pay bills online from QuickBooks Desktop Use Online Bill Pay in QuickBooks DesktopOn the other hand, if you want to utilize other supported apps, you can look for one from here: Apps for QuickBooks Desktop.Thank you for your first visit here in the Community. If you have follow-up questions while working with your bill payment entries, let me know by leaving a comment below. I'm always here to help. Have a good one! direct connect I'm totally unclear why this feature is so misunderstood by so many including the banks themselves. Direct Connect is a feature that connects DIRECTLY and ONLY with a bank. Through it, I just write a check in the register and type "SEND" in the check number slot. Then I go to bank feeds and sync with the bank. Out goes my new checks that had "SEND" on them and in comes any new transactions directly to my register.My issue is TRUIST has an incredibly bad Direct Connect superset. I canNOT put a message in the memo field of the check (HUGE downside because that's where I normally put the invoice number of the bill I'm paying) AND I never get a check number back. Instead it says "CHK" in the check number slot. I'm looking for a bank with both of

2025-04-04Fees. Payment processing aside, the app syncs transactions with your QuickBooks account, calculates and applies sales tax, sends receipts by text or email and lets you add and manage sales items.QuickBooks card readerThe QuickBooks card reader accepts dipped and tapped card payments, along with digital wallet payments like Google Pay and Apple Pay. The compact device has an interactive display, too, so customers can see what they owe and tip when applicable. The reader is compatible with iPhones and Androids.Your business starter kitThe tools and tips you need to start your business.Financial planning for your business$700+ in product discountsYour starter checklistNew business trainingQuickBooks Payments pricingRates and fees vary depending on whether you accept payments through QuickBooks Online, QuickBooks Desktop, QuickBooks POS or the GoPayment app. Promotions may be available for businesses that charge more than $7,500 per month, and 30-day free trials are also available. There is a $25 chargeback fee and PCI compliance service costs $9.95 per month.QuickBooks Online and QuickBooks GoPaymentNo monthly fee.2.4% plus 25 cents per swiped, dipped, tapped and contactless transaction.3.4% plus 25 cents per keyed-in transaction.2.9% plus 25 cents per invoiced transaction.1% per ACH bank transfer (max $10 per transaction).QuickBooks DesktopPay as you goNo monthly fee.2.4% plus 30 cents per swiped transaction.3.5% plus 30 cents per keyed-in transaction.3.5% plus 30 cents per invoiced transaction.$3 per ACH bank transfer.Pay monthly$20 per month.1.6% plus 30 cents per swiped transaction.3.3% plus 30 cents per keyed-in transaction.3.3% plus 30 cents per invoiced transaction.$3 per ACH bank transfer.QuickBooks POSPay as you goNo monthly fee.2.7% per swiped or dipped transaction.1% per swiped or dipped transaction with PIN.3.5% per keyed-in transaction.Pay monthly$20 per month.2.3% per swiped or dipped transaction.1% per swiped or dipped transaction with PIN.3.2% per keyed-in transaction.Make payments make senseFind the right payment provider to meet your unique business needs.QuickBooks Payments benefitsConvenient mobile appOne of the GoPayment app’s greatest strengths is its simplicity. Businesses can log into the free mobile POS app using their QuickBooks accounting information, and they don’t need a card reader to start processing keyed-in transactions on the go. For businesses that only need a mobile POS solution occasionally, the app plus card reader is a low-commitment, affordable option.Seamless QuickBooks accounting integrationQuickBooks has built its own ecosystem of small-business software products — including accounting, payroll, time-tracking, POS systems and payment processing — that sync up with each other and minimize manual data entry. If you use QuickBooks

2025-04-202.5% or 2.6% plus 10 cents for in-person payments for Advanced, Shopify or Basic plan, respectively.PayoneerBest international money transfer appWhy we like it: Payoneer is a money transfer app for businesses that don’t want a full payment processing service or need to take payments in person. Unlike Venmo, it’s available in different countries outside of the U.S. and allows you to convert currencies. You’ll save the most if your customers have their own Payoneer accounts and pay you with their balance. Read our full Payoneer review. Payoneer charges an annual account fee of $29.95 if you don’t use your account for 12 months. Here are the additional transaction fees: Up to 3.99% for credit card transactions (all currencies), plus $0.49 in some countries.1% for ACH bank debit transactions.0% to receive payments from other Payoneer users.$1.50 to transfer funds from Payoneer to your bank account; up to 3% to transfer from a non-local currency.SquareBest all-in-one POS system and payment processingWhy we like it: Square rivals PayPal in popularity, and for good reason. It offers a variety of payment processing solutions, including the ability to accept chip, swipe and contactless forms of payment. It also sells some of the most popular payment processing hardware, including the Square magstripe reader and Square Register. Its free POS software makes it one of the best PayPal alternatives for brick-and-mortar businesses. Read our full Square POS review.2.6% plus 10 cents for in-person transactions.2.9% plus 30 cents for online transactions.3.5% plus 15 cents for manually keyed transactions.3.3% plus 30 cents for invoices.QuickBooks GoPaymentBest accounting software integrationWhy we like it: The QuickBooks GoPayment app is a simple, no-frills solution for accepting in-person payments on the go. Similar to PayPal, there are no monthly software fees (aside from your accounting software subscription) and the app is free. Read our full QuickBooks GoPayment review. For QuickBooks Online users2.5% for in-person payments.2.99% for online and invoiced payments.3.5% for manually keyed payments.1% for ACH transactions.For QuickBooks Desktop usersPay as you go plan (no monthly fee):2.4% plus 30 cents per in-person transaction.3.5% plus 30 cents per keyed-in or invoiced transaction.$3 per ACH transfer.Pay monthly plan ($20 monthly fee):1.6% plus 30 cents per in-person transaction.3.3% plus 30 cents per keyed-in or invoiced transaction.$3 per ACH transfer.PayPal pros and cons Identifying what you like and dislike about PayPal can help you choose the right alternative for your business. Here are some of PayPal’s strengths and

2025-04-24