Merchant cash advance calculator

Author: m | 2025-04-25

Merchant Cash Advance Calculator: Find Your Borrowing Costs; Merchant Cash Advance Fee Structure; Use the Merchant Cash Advance Calculator to Estimate Payments. Additional Fees to Consider When Using an find out more about merchant cash advance calculator you can click: video is about merchant cash advance calcul

Merchant Cash Advance (MCA) Calculator

Advance that you might want to consider:The cost may be higher than a standard business loan. The fee, based on the factor rate, is set at the start of the loan. Even if your business grows stronger and more creditworthy over time, it will not reduce the fee you pay.Because a merchant cash advance is based on card terminal receipts, you will not qualify if you receive payment by other means, such as cash, cheque, or bank transfers.With most lenders, the maximum loan amount is 1-2 times the value of your monthly card transactions. If you need to borrow a significantly larger amount, a merchant cash advance is probably not the choice for you. Merchant cash advance calculator My factor rate from the lender is-% I take on average per month in card sales $ - I want to repay back of future card sales4% This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan. Your results Daily average repayment $- Repaid in (approx.) - days Borrow $ Merchant cash advance requirementsThe number one requirement for a merchant cash advance is an established history of processing a steady flow of credit card transactions. When you apply, you will likely be asked to provide several months of card transaction history as well as bank statements.Another requirement is a completed application form, but this is usually relatively short and simple, and approval times are often quick – sometimes as short as 24 hours.In some cases, you may be required to switch card terminal providers. Although this step is inconvenient, it can be a condition of approval from some lenders. It is definitely not always required.What are the interest rates?A merchant cash advance does not have an interest rate in the usual sense. Instead, you pay a fee of a certain number of cents per dollar borrowed. This is usually expressed as a “factor rate.” For example, a fee of 20 cents per dollar is expressed as a factor rate of 1.20.To see how much you will have to repay,

Merchant Cash Advance Calculator - Approvity

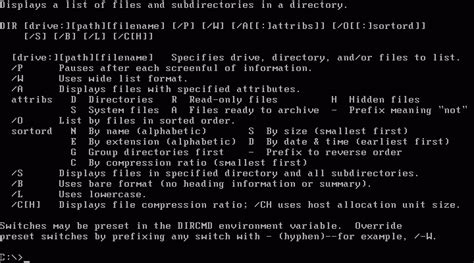

Full SpecificationsGENERALReleaseMarch 28, 2013Latest updateMarch 28, 2013Version2.0OPERATING SYSTEMSPlatformWindowsOperating SystemWindows 10Windows 7Windows VistaWindows 98Windows 2003Windows 2000Windows XPWindows MEWindows ServerWindows 8Windows NTAdditional RequirementsMicrosoft Excel 2003 or newerPOPULARITYTotal Downloads572Downloads Last Week0Report SoftwareProgram available in other languagesDescargar Merchant Cash Advance and Loan CalculatorLast UpdatedNitro ProTrial versionMicrosoft Project Professional 2016Trial versionWindows 365SubscriptionVirtual DriveFreeMinecraft: Java & Bedrock EditionPaidLibros de IVA y ContabilidadPaidMicrosoft Excel 2016Trial versionGTA 6PaidMalwarebytes Anti-MalwareFreeAdobe Photoshop CS6 updateFreeHP DeskJet Ink Advantage 2135 All-in-One Printer driversFreeMicrosoft Office 2021FreeUser Reviews5/51 User VotesVery easy and useful for estimating payments and cost.toezupApril 5, 2013ProsVery easy to use. You can use it to estimate a merchant cash advance hold back as well as an unsecured loan calculator for daily payments. Very useful when shopping for a loan because you can change the costs and terms to anything you want. Helps with comparing offers.ConsIt's only for merchant cash advances and unsecured loans.SummaryGreat super easy business loan cost calculator and payment estimator.Merchant Cash Advance APR Calculator

Pay to the lender does not change, but the sum you repay daily, weekly, or monthly, does. It will fluctuate to match your card payment income. (This flexibility can work particularly well for businesses with variable or seasonal income).By design, merchant cash advances make repayment simple and you never have to worry about sending a remittance. Loan repayments are taken ‘at source’, which means they are sent directly to the lender by your card terminal provider. How much you can borrow will depend on factors such as your card turnover and the repayment sum the lender is confident you can comfortably afford. Andrea ReynoldsSwoop’s CEO & Co-Founder A word from Andrea "With a merchant cash advance (MCA) you can unlock future income to provide immediate cash. The lender provides a lump sum that’s repaid from customer card receipts. Repayments are made on a daily, weekly, or monthly basis and as a fixed percentage of card payment receipts." Is a merchant cash advance a loan?Yes and no. Technically, all types of borrowing are a loan, but merchant cash advances differ from standard business loans in several ways.Firstly, a merchant cash advance is unsecured. It does not require collateral, or assets to back the loan. You do not need to be a homeowner. The money is lent to your business and you pay it back as a percentage of your card payment income. The volume of your card payments and the amount of money your business makes are what qualify you for the loan and how much the lender will advance to you.Secondly, merchant cash advances adapt to your business. As you grow, you repay faster. During lulls, you repay slower. The time it takes to clear the loan is determined by the performance of your business. However, like other loans, an MCA has a fixed ‘sunset’ point – which is the final date for full repayment of the loan. This can be short – three months, or long – three years.Thirdly, standard business loans may incur hefty late charges or penalties for early repayment. A merchant cash advance does not. Because. Merchant Cash Advance Calculator: Find Your Borrowing Costs; Merchant Cash Advance Fee Structure; Use the Merchant Cash Advance Calculator to Estimate Payments. Additional Fees to Consider When Using an find out more about merchant cash advance calculator you can click: video is about merchant cash advance calculMerchant cash advance (MCA) calculator

Will repay £1.35. Typical factor rates are 7p to 35p per pound borrowed.Some business loans (for example a bank overdraft) charge interest according to the sum outstanding. The interest paid each month may be based on a variable rate, meaning it can go up or down depending on the bank base rate set by the Bank of England. Merchant cash advances do away with that volatility. The fee is set at the start of the loan and it does not fluctuate. You borrow a lump sum and then pay that back incrementally, plus the fee, via your customer card payments.Merchant cash advance calculator My factor rate from the lender is-% I take on average per month in card sales £ - I want to repay back of future card sales4% This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan. Your results Daily average repayment £- Repaid in (approx.) - days Borrow £ What are the benefits of merchant cash advances?Merchant cash advances are flexible and scalable. They adapt to the growth and operating pattern of your business. You pay back what your business can afford based on your customer card income. Pay more when business is going well, pay less if things slow down.Merchant cash advances may be secured without collateral or a deep review of your accounts. They are a good option for businesses with limited credit history or few to no hard assets.Unlike many other forms of business funding, an MCA can often be secured quickly. In some cases, a loan offer can be made within 24 hours of application.Repayments are taken at source. There’s no need to waste time juggling your cashflow to meet an upcoming payment. You concentrate on your business and you let the loan take care of itself.There are no hidden fees. The factor rate, (cost of the loan), is set at the start. You know what you pay from the moment the loan is made.What are the downsides?There are few disadvantages to a merchant cash advance. However, the costMerchant Cash Advance Loan Calculator

Providing a systematic way to account for the reduction in value over time. This is a common method used in accounting to allocate the cost of assets and determine their book value. All calculators 401k retirement calculator ADR calculator APY calculator Acid test ratio calculator Amortization calculator Asset finance calculator Auto loan calculator Basis point calculator Break even calculator Business loan calculator Business savings calculator Business valuation calculator California sales tax calculator Car finance calculator Car finance settlement calculator Cash flow calculator Commercial mortgage calculator Commercial real estate calculator Compound annual growth rate calculator Compound interest calculator Cost of equity calculator Currency converter Debt service coverage ratio calculator Development finance calculator Dividend calculator EBITDA calculator Employee retention credit calculator Florida sales tax calculator Franchise loan calculator Home equity line of credit payoff calculator Inflation calculator Internal rate of return calculator Invoice factoring calculator Invoice finance calculator Lease calculator Line of credit calculator Loss ratio calculator Marginal cost calculator Merchant cash advance (MCA) calculator Missouri sales tax calculator Mortgage overpayment calculator Net profit margin calculator New Jersey sales tax calculator Ohio sales tax calculator Operating margin calculator PayPal fee calculator Percentage calculator Pre money valuation calculator Price elasticity of demand calculator Price per square foot calculator Price to earnings calculator R&D tax credit calculator Rate of return calculator Receivables turnover calculator Refinance calculator Rent vs. buy calculator Return on capital employed calculator Return on investment calculator Revenue calculator SBA loan calculator Sales tax calculator Short term business loan calculator Weighted averagemerchant Cash Advance Calculator - YouTube

Add a header to begin generating the table of contents Page written by Michael David. Last reviewed on March 11, 2025. Next review due October 1, 2026. If your businesses processes a good volume of daily credit card transactions, a merchant cash advance is one of the faster and more flexible ways to access some extra cash when you need it. Apply in minutes and we’ll sift through the options from banks and other lenders to find the money you need.Add a header to begin generating the table of contentsWhat is a merchant cash advance?A merchant cash advance, sometimes also known as a business cash advance, lets you borrow against your future credit card transaction revenue.Imagine this: you need some extra cash today, but you don’t have business assets that you can pledge as collateral for a standard business loan. Instead, you can ask for a cash advance from a lender now and repay it through a fixed percentage of your daily, weekly or monthly credit card payment receipts. If business grows, you will repay the advance more quickly. If things are slow, you get more time. It’s a fast and flexible solution for many small businesses in areas like food and beverage, retail and leisure.How do they work?Any business that receives payment via a card terminal may qualify for a merchant cash advance. Because the lender works with the card terminal provider that processes your transactions, they can easily see the volume of card payments your business receives. The lender uses this information to calculate the sum they will lend and a plan to pay back the loan.Because the loan and repayment plan are based on the volume and value of your transactions, merchant cash advances adapt to the way your business operates. The percentage of customer receipts you pay to the lender does not change, but the sum you repay daily, weekly, or monthly, does. It will fluctuate to match your card payment income. This flexibility can work particularly well for businesses with variable or seasonal income.Merchant cash advances make repayment simple. The repayments are taken “at source,”. Merchant Cash Advance Calculator: Find Your Borrowing Costs; Merchant Cash Advance Fee Structure; Use the Merchant Cash Advance Calculator to Estimate Payments. Additional Fees to Consider When Using an find out more about merchant cash advance calculator you can click: video is about merchant cash advance calculComments

Advance that you might want to consider:The cost may be higher than a standard business loan. The fee, based on the factor rate, is set at the start of the loan. Even if your business grows stronger and more creditworthy over time, it will not reduce the fee you pay.Because a merchant cash advance is based on card terminal receipts, you will not qualify if you receive payment by other means, such as cash, cheque, or bank transfers.With most lenders, the maximum loan amount is 1-2 times the value of your monthly card transactions. If you need to borrow a significantly larger amount, a merchant cash advance is probably not the choice for you. Merchant cash advance calculator My factor rate from the lender is-% I take on average per month in card sales $ - I want to repay back of future card sales4% This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan. Your results Daily average repayment $- Repaid in (approx.) - days Borrow $ Merchant cash advance requirementsThe number one requirement for a merchant cash advance is an established history of processing a steady flow of credit card transactions. When you apply, you will likely be asked to provide several months of card transaction history as well as bank statements.Another requirement is a completed application form, but this is usually relatively short and simple, and approval times are often quick – sometimes as short as 24 hours.In some cases, you may be required to switch card terminal providers. Although this step is inconvenient, it can be a condition of approval from some lenders. It is definitely not always required.What are the interest rates?A merchant cash advance does not have an interest rate in the usual sense. Instead, you pay a fee of a certain number of cents per dollar borrowed. This is usually expressed as a “factor rate.” For example, a fee of 20 cents per dollar is expressed as a factor rate of 1.20.To see how much you will have to repay,

2025-04-04Full SpecificationsGENERALReleaseMarch 28, 2013Latest updateMarch 28, 2013Version2.0OPERATING SYSTEMSPlatformWindowsOperating SystemWindows 10Windows 7Windows VistaWindows 98Windows 2003Windows 2000Windows XPWindows MEWindows ServerWindows 8Windows NTAdditional RequirementsMicrosoft Excel 2003 or newerPOPULARITYTotal Downloads572Downloads Last Week0Report SoftwareProgram available in other languagesDescargar Merchant Cash Advance and Loan CalculatorLast UpdatedNitro ProTrial versionMicrosoft Project Professional 2016Trial versionWindows 365SubscriptionVirtual DriveFreeMinecraft: Java & Bedrock EditionPaidLibros de IVA y ContabilidadPaidMicrosoft Excel 2016Trial versionGTA 6PaidMalwarebytes Anti-MalwareFreeAdobe Photoshop CS6 updateFreeHP DeskJet Ink Advantage 2135 All-in-One Printer driversFreeMicrosoft Office 2021FreeUser Reviews5/51 User VotesVery easy and useful for estimating payments and cost.toezupApril 5, 2013ProsVery easy to use. You can use it to estimate a merchant cash advance hold back as well as an unsecured loan calculator for daily payments. Very useful when shopping for a loan because you can change the costs and terms to anything you want. Helps with comparing offers.ConsIt's only for merchant cash advances and unsecured loans.SummaryGreat super easy business loan cost calculator and payment estimator.

2025-04-24Will repay £1.35. Typical factor rates are 7p to 35p per pound borrowed.Some business loans (for example a bank overdraft) charge interest according to the sum outstanding. The interest paid each month may be based on a variable rate, meaning it can go up or down depending on the bank base rate set by the Bank of England. Merchant cash advances do away with that volatility. The fee is set at the start of the loan and it does not fluctuate. You borrow a lump sum and then pay that back incrementally, plus the fee, via your customer card payments.Merchant cash advance calculator My factor rate from the lender is-% I take on average per month in card sales £ - I want to repay back of future card sales4% This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan. Your results Daily average repayment £- Repaid in (approx.) - days Borrow £ What are the benefits of merchant cash advances?Merchant cash advances are flexible and scalable. They adapt to the growth and operating pattern of your business. You pay back what your business can afford based on your customer card income. Pay more when business is going well, pay less if things slow down.Merchant cash advances may be secured without collateral or a deep review of your accounts. They are a good option for businesses with limited credit history or few to no hard assets.Unlike many other forms of business funding, an MCA can often be secured quickly. In some cases, a loan offer can be made within 24 hours of application.Repayments are taken at source. There’s no need to waste time juggling your cashflow to meet an upcoming payment. You concentrate on your business and you let the loan take care of itself.There are no hidden fees. The factor rate, (cost of the loan), is set at the start. You know what you pay from the moment the loan is made.What are the downsides?There are few disadvantages to a merchant cash advance. However, the cost

2025-04-25Providing a systematic way to account for the reduction in value over time. This is a common method used in accounting to allocate the cost of assets and determine their book value. All calculators 401k retirement calculator ADR calculator APY calculator Acid test ratio calculator Amortization calculator Asset finance calculator Auto loan calculator Basis point calculator Break even calculator Business loan calculator Business savings calculator Business valuation calculator California sales tax calculator Car finance calculator Car finance settlement calculator Cash flow calculator Commercial mortgage calculator Commercial real estate calculator Compound annual growth rate calculator Compound interest calculator Cost of equity calculator Currency converter Debt service coverage ratio calculator Development finance calculator Dividend calculator EBITDA calculator Employee retention credit calculator Florida sales tax calculator Franchise loan calculator Home equity line of credit payoff calculator Inflation calculator Internal rate of return calculator Invoice factoring calculator Invoice finance calculator Lease calculator Line of credit calculator Loss ratio calculator Marginal cost calculator Merchant cash advance (MCA) calculator Missouri sales tax calculator Mortgage overpayment calculator Net profit margin calculator New Jersey sales tax calculator Ohio sales tax calculator Operating margin calculator PayPal fee calculator Percentage calculator Pre money valuation calculator Price elasticity of demand calculator Price per square foot calculator Price to earnings calculator R&D tax credit calculator Rate of return calculator Receivables turnover calculator Refinance calculator Rent vs. buy calculator Return on capital employed calculator Return on investment calculator Revenue calculator SBA loan calculator Sales tax calculator Short term business loan calculator Weighted average

2025-04-11Which means they are sent directly to the lender by your card terminal provider. How much you can borrow will depend on factors such as how much credit card business you process and the total amount the lender is confident you can comfortably afford.Is a merchant cash advance a business loan?Technically, all types of borrowing for a small business or startup can be considered a business loan, but merchant cash advances differ from standard business loans in several ways.For one thing, a merchant cash advance is unsecured. That means it does not require collateral such as inventory, equipment or real estate to back the loan. The money is lent to your business and you pay it back as a percentage of your card payment income. The volume of your card payments and the amount of money your business makes are what determine whether you qualify and how much you can borrow.Another difference is in how merchant cash advances can adapt to your business. As you grow, you repay faster. During lulls, you repay slower. The time it takes to clear the loan is determined by the performance of your business. However, like other loans, a merchant cash advance does have a final date for full repayment of the loan. This can be anywhere from a few months to a few years in the future. Finally, standard business loans can come with hefty late charges or penalties for early repayment. A merchant cash advance does not. Because repayments are automatically deducted from your daily, weekly or monthly card transactions, it is not possible to be late, so there can be no late charges. If your small business or startup grows rapidly, you’ll pay the loan back sooner without worrying about penalties.What can I use a merchant cash advance for?You can use a merchant cash advance for just about any legitimate business purpose, including:Buying inventoryRenovating or expanding your premisesCovering a cashflow shortagePaying taxes or vendorsAdvertising and marketingHiring and trainingPurchasing equipmentIn short, if your small business or startup needs money to grow, a merchant cash advance could work for you.Merchant cash advance examplesA

2025-04-24Restaurant had to make some unplanned renovations in order to comply with new COVID-19 pandemic regulations. A merchant cash advance was the perfect way to get some extra cash on short notice, and the renovations will help him accelerate his sales and speed up his repayments.A hotel wanted to take advantage of an upcoming holiday period to attract more customers. They used a merchant cash advance to fund an online advertising campaign, which should help them book more rooms and repay the advance ahead of schedule.A spa is interested in acquiring new equipment that will allow them to offer additional services and generate more revenue per customer. A merchant cash advance was a flexible way to get the money they need right now and pay it back our of future sales.What are the benefits? Pros There are many potential benefits, including:Merchant cash advances are flexible and scalable. They adapt to the growth and operating pattern of your business. You pay back what your business can afford based on your customer card income. Pay more when business is going well, pay less if things slow down.Because you can often obtain a merchant cash advance without collateral or a deep review of your financial statements, they are a good option for businesses with limited credit history or a lack of assets that they can pledge as security for a loan.Unlike many other forms of business funding, a merchant cash advance can often be secured quickly. In some cases, a loan offer can be made within 24 hours of application.Repayments are taken at source. There’s no need to waste time juggling your cashflow to meet an upcoming payment. You concentrate on your business and you let the loan take care of itself.There are no hidden fees. The cost of the loan, based on the factor rate, is set at the start. You know what you pay from the moment the loan is made.Interested in a merchant cash advance? You can get started in minutes when you join Swoop. What are the downsides? Cons Here are a few potential downsides to a merchant cash

2025-04-18