Truelane hartford

Author: b | 2025-04-24

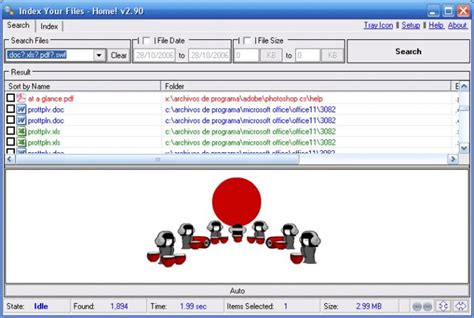

TrueLane from The Hartford สำหรับ Android การดาวน์โหลดฟรีและปลอดภัย TrueLane from The Hartford

TrueLane by The Hartford by The Hartford - appadvice.com

System (if it’s eligible).Discounts will be adjusted at every renewal period, and can change as a result of your driving. You can sign up online, or contact an agent to enroll.The Hartford TrueLane® The Hartford TrueLane - how it works, how to save TrueLane® - Potential SavingsHow It Works Enrollment: 5% per vehicle for signing upPowered by a plug-in device Safe Driving: up to 25%Tracks behaviors including speeding and brakingCompare RatesStart Now →Drivers insured with The Hartford have an opportunity to earn discounts through the provider’s TrueLane® program.Those enrolled in TrueLane® will receive a free device that plugs into their car’s OBD-II port, and will be able to view their progress online or through the TrueLane® app. Successful participants can earn as much as 25% in savings.TrueLane® is available in the following states: Arizona, Arkansas, Connecticut, Minnesota, Missouri, Nevada, New Mexico, Oklahoma, Oregon, South Carolina, Virginia, and West Virginia.Travelers IntelliDrive®Travelers Intellidrive - how it works, how to save IntelliDrive® - Potential SavingsHow It Works Enrollment: discount amount unspecifiedPowered by an app Safe Driving: up to 20%Tracks speed, acceleration, braking, and time of dayCompare RatesStart Now →Travelers auto insurance customers looking to save have an option through the Travelers IntelliDrive® program. Depending on where drivers live, they can earn savings as high as 20%.IntelliDrive® participants will be tracked for 90 days through the app, which will generate a star rating. How many stars you receive (five is the highest) will impact your rate at your next renewal.Don’t miss it! With the exception of Washington, D.C., Maryland, Montana, Pennsylvania, and Virginia, riskier driving habits can lead to a increased auto insurance rates when using IntelliDrive®.IntelliDrive is available in the following states: Arizona, Alabama, Colorado, Connecticut, Washington, D.C., Florida, Georgia, Iowa, Idaho, Illinois, Indiana, Kansas, Kentucky, Massachusetts, Maryland, Maine, Minnesota, Missouri, Mississippi, Montana,. TrueLane from The Hartford สำหรับ Android การดาวน์โหลดฟรีและปลอดภัย TrueLane from The Hartford TrueLane from The Hartford สำหรับ Android การดาวน์โหลดฟรีและปลอดภัย TrueLane from The Hartford TrueLane de The Hartford- Telematics. APPPARAPC.com. Inicio Categor as Buscar . Inicio Finanzas TrueLane from The Hartford para PC. TrueLane from The Hartford para PC. TrueLane by The Hartford is a Freeware software in the category Education developed by The Hartford. The latest version of TrueLane by The Hartford is 2.0.0, released on . It TrueLane by The Hartford is a Freeware software in the category Education developed by The Hartford. The latest version of TrueLane by The Hartford is 2.0.0, released on . It TrueLane from The Hartford is Free Finance app, developed by The Hartford. Latest version of TrueLane from The Hartford is 2.0.0, was released on (updated on ). Overall rating of TrueLane from The Hartford is 4.7. This app had been rated by 5963 users. How to install TrueLane from The Hartford on Windows and MAC? TrueLane from The Hartford is Free Finance app, developed by The Hartford. Latest version of TrueLane from The Hartford is 2.0.0, was released on (updated on ). Overall rating of TrueLane from The Hartford is 4.7. This app had been rated by 5963 users. How to install TrueLane from The Hartford on Windows and MAC? TrueLane from The Hartford is Free Finance app, developed by The Hartford. Latest version of TrueLane from The Hartford is 2.0.0, was released on (updated on ). Overall rating of TrueLane from The Hartford is 4.7. This app had been rated by 5963 users. How to install TrueLane from The Hartford on Windows and MAC? Call The Hartford today at 888-546-9099 or get a quote online. Mature drivers can save on their senior car insurance rates through: Safe driver training discounts: You can get a discount for drivers who are under 21 years old (under 25 in Georgia) if they finish an approved training course. Defensive driver courses: If you’ve finished an approved defensive driving course, you can save money on your car insurance. Safety features: You can save more if your car has safety features, like anti-lock brakes. Maintaining a clean driving record: It pays to be a good driver. Avoid claims and maintain safe driving habits to help keep your car insurance premium low. Drive safe and save: Drive your price with our TrueLane Program.^ You’ll save up to 15%^ when you sign up within 60 days of your first policy. Plus, you could earn a renewal discount of up to 40%, depending on your safe driving habits. Riskier habits may result in a higher premium. 2,3 Auto insurance rates by age range from 9/1/22 to 8/31/23. 4 Insurance Information Institute (III), “Senior Driving Safety and Insurance Tips” *** Based on Maine Auto policyholders 1 vehicle and driver; individual rate/premium/savings will vary based on actual coverage selections and vehicle(s)/driver(s) characteristics. ^ Not available in all states, terms and conditions apply. † Average savings amounts are derived from 6-month policy terms and based on information reported by customers who switched to The Hartford's newest rate plan between 9/1/22 and 8/31/23. This data is also used to determine the number/percentage of individuals who saved money when they switched. Your savings may vary. Rate differences for AARP members and non-members vary by state and AARP membership tenure. ** Average savings amounts based on information reported by customers who switched to The Hartford from other carriers betweenComments

System (if it’s eligible).Discounts will be adjusted at every renewal period, and can change as a result of your driving. You can sign up online, or contact an agent to enroll.The Hartford TrueLane® The Hartford TrueLane - how it works, how to save TrueLane® - Potential SavingsHow It Works Enrollment: 5% per vehicle for signing upPowered by a plug-in device Safe Driving: up to 25%Tracks behaviors including speeding and brakingCompare RatesStart Now →Drivers insured with The Hartford have an opportunity to earn discounts through the provider’s TrueLane® program.Those enrolled in TrueLane® will receive a free device that plugs into their car’s OBD-II port, and will be able to view their progress online or through the TrueLane® app. Successful participants can earn as much as 25% in savings.TrueLane® is available in the following states: Arizona, Arkansas, Connecticut, Minnesota, Missouri, Nevada, New Mexico, Oklahoma, Oregon, South Carolina, Virginia, and West Virginia.Travelers IntelliDrive®Travelers Intellidrive - how it works, how to save IntelliDrive® - Potential SavingsHow It Works Enrollment: discount amount unspecifiedPowered by an app Safe Driving: up to 20%Tracks speed, acceleration, braking, and time of dayCompare RatesStart Now →Travelers auto insurance customers looking to save have an option through the Travelers IntelliDrive® program. Depending on where drivers live, they can earn savings as high as 20%.IntelliDrive® participants will be tracked for 90 days through the app, which will generate a star rating. How many stars you receive (five is the highest) will impact your rate at your next renewal.Don’t miss it! With the exception of Washington, D.C., Maryland, Montana, Pennsylvania, and Virginia, riskier driving habits can lead to a increased auto insurance rates when using IntelliDrive®.IntelliDrive is available in the following states: Arizona, Alabama, Colorado, Connecticut, Washington, D.C., Florida, Georgia, Iowa, Idaho, Illinois, Indiana, Kansas, Kentucky, Massachusetts, Maryland, Maine, Minnesota, Missouri, Mississippi, Montana,

2025-03-28Call The Hartford today at 888-546-9099 or get a quote online. Mature drivers can save on their senior car insurance rates through: Safe driver training discounts: You can get a discount for drivers who are under 21 years old (under 25 in Georgia) if they finish an approved training course. Defensive driver courses: If you’ve finished an approved defensive driving course, you can save money on your car insurance. Safety features: You can save more if your car has safety features, like anti-lock brakes. Maintaining a clean driving record: It pays to be a good driver. Avoid claims and maintain safe driving habits to help keep your car insurance premium low. Drive safe and save: Drive your price with our TrueLane Program.^ You’ll save up to 15%^ when you sign up within 60 days of your first policy. Plus, you could earn a renewal discount of up to 40%, depending on your safe driving habits. Riskier habits may result in a higher premium. 2,3 Auto insurance rates by age range from 9/1/22 to 8/31/23. 4 Insurance Information Institute (III), “Senior Driving Safety and Insurance Tips” *** Based on Maine Auto policyholders 1 vehicle and driver; individual rate/premium/savings will vary based on actual coverage selections and vehicle(s)/driver(s) characteristics. ^ Not available in all states, terms and conditions apply. † Average savings amounts are derived from 6-month policy terms and based on information reported by customers who switched to The Hartford's newest rate plan between 9/1/22 and 8/31/23. This data is also used to determine the number/percentage of individuals who saved money when they switched. Your savings may vary. Rate differences for AARP members and non-members vary by state and AARP membership tenure. ** Average savings amounts based on information reported by customers who switched to The Hartford from other carriers between

2025-04-05Review for 2025Travelers IntelliDrive Program Review in 2025 (Driver Monitoring for Potential Savings)State Farm Drive Safe and Save or OnStar Program Review for 2025Progressive Snapshot Program Review for 2025Nationwide SmartRide Review for 2025Liberty Mutual RightTrack Review for 2025Farmers Signal App Review for 2025Green Commuting in 2025 (Why it Matters)We’ll give a usage-based insurance definition and look at how different insurance companies are competing in the usage-based insurance market.Do you feel like you’re being overcharged for your auto insurance? Enter your ZIP code into our free online quote comparison tool. In minutes, you can get several auto insurance quotes from the best providers in your area.Now to help you pick the type of insurance that’s best for you, let’s dive in to learn more about the top usage -based options that thousands of Americans are switching to.Which companies use telematics and usage-based insurance?Allstate Drivewise®American Family KnowYourDriveFarmers Signal®Geico DriveEasyLiberty Mutual RightTrack®MetLife MyJourney®Nationwide SmartRide®Progressive SnapshotRoot InsuranceSafeco RightTrack®State Farm Drive Safe & Save™The Hartford TrueLane®Travelers IntelliDrive®USAA SafePilotPay-Per-Mile Usage-Based Auto Insurance ProgramsAllstate Milewise®Liberty Mutual ByMile™MetroMileMileautoNationwide SmartMiles®Understanding Telematics and Usage-Based Auto InsuranceHow do telematics and usage-based auto insurance programs work?Why are auto insurance companies tracking my driving?Pros and Cons of Usage-Based InsuranceFrequently Asked Questions about Telematics and Usage-Based Insurance#1 – Will usage-based auto insurance drain my cell phone data and battery?#2 – Do long road trips count against you on a pay per mile program?#3 – What is considered low-mileage for auto insurance?#4 – Is my auto insurance company selling my information?#5 – What if my car doesn’t have an OBD-II port?#6 – Can I stop participating in a usage-based insurance program?Usage-Based Auto Insurance and Telematics: Growing PopularityWhich companies use telematics and usage-based insurance?Experts with Cambridge Mobile Telematics estimate that roughly eight million North American drivers are taking advantage of usage-based insurance.Whether they’re insured with major

2025-03-28Program from The Hartford is underwritten by Hartford Fire Insurance Company and its affiliates, One Hartford Plaza, Hartford, CT 06155. It is underwritten in AZ, MI and MN by Hartford Insurance Company of the Southeast; in CA by Property and Casualty Insurance Company of Hartford; in WA, by Trumbull Insurance Company; in MA, by Trumbull Insurance Company, Sentinel Insurance Company, Hartford Insurance Company of the Midwest, and Hartford Accident and Indemnity Company; and in PA, by Nutmeg Insurance Company. Home product is not available in all areas, including the state of FL. Savings, benefits and coverages may vary and some applicants may not qualify. The Program is currently unavailable in Canada and U.S. Territories or possessions.1 In Texas, the Auto Program is underwritten by Redpoint County Mutual Insurance Company through Hartford of the Southeast General Agency, Inc. Hartford Fire Insurance Company and its affiliates are not financially responsible for insurance products underwritten and issued by Redpoint County Mutual Insurance Company. The Home Program is underwritten by Hartford Insurance Company of the Southeast. * Customer reviews are collected and tabulated by The Hartford and not representative of all customers.

2025-04-01